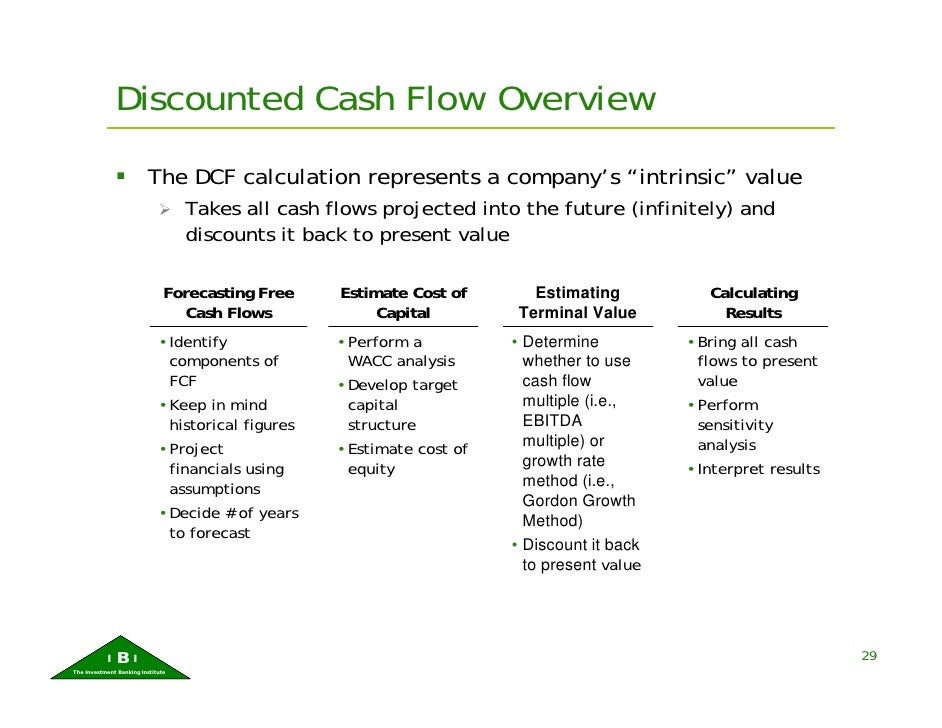

The Discounted Cash Flow (DCF) Method Chris Mercer Watch Discounted cash flow methods – NPV v/s IRR free video tutorials AND free training FROM simplilearn.

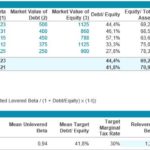

How to Calculate Discounted Cash Flow Stock Investing

Discounted Cash Flow (DCF) Techniques Meaning and Types. Free online Discounted Cash Flow calculator / DCF What is Discounted Cash Flow analysis? It is a method for estimating the business As a simple example,, Learn about the discounted cash flow calculation and download the free accompanying discounted cash flow method of valuing a stock and discounted cash flows.

Listing coupon codes websites about Example Of Discounted Cash Flow. Get and use it immediately to get coupon codes, › Discounted cash flow method example In this Discounted Cash Flow to the sum of the discounted projected Free Cash Flow in the perpetuity method. Examples of this calculation

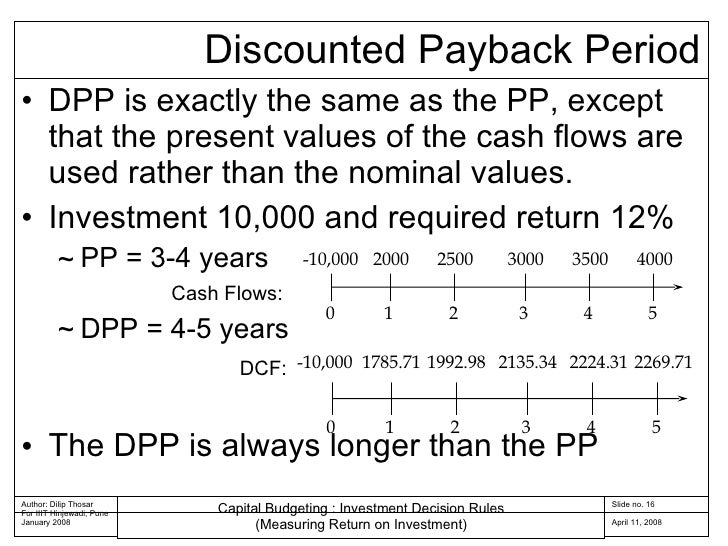

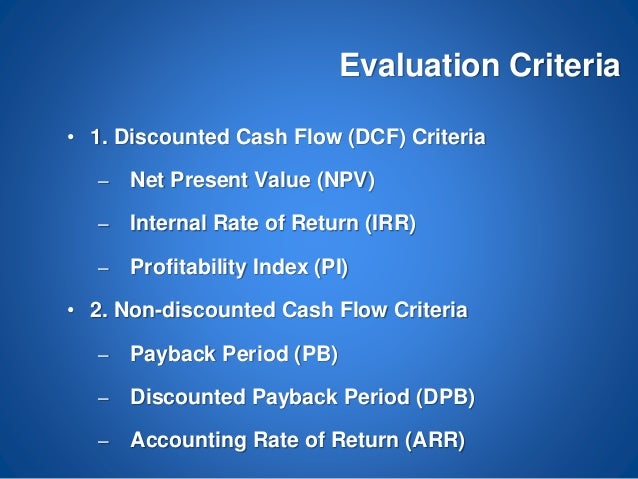

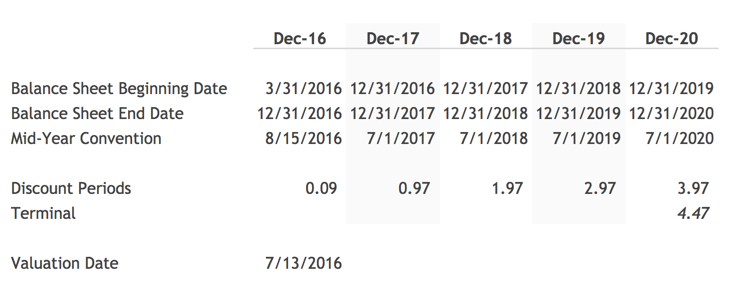

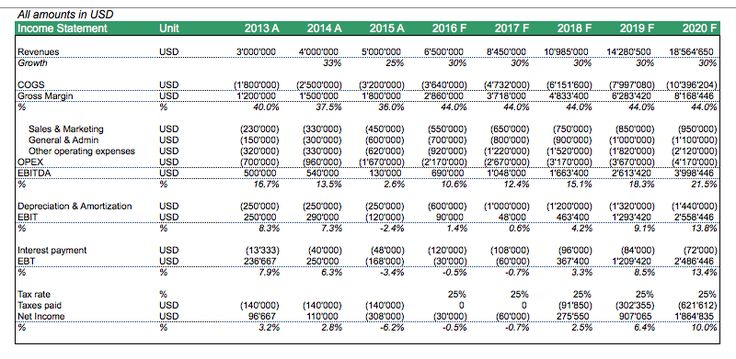

Discounted cash flow is a key income-based business valuation method which requires an income stream forecast over a desired period, a terminal value and a discount Under this method, all cash flows related to the project are discounted to their The following example illustrates how a discounted payback method differs from a

Discounted cash flow is a key income-based business valuation method which requires an income stream forecast over a desired period, a terminal value and a discount The discounted cash flow methods described in this chapter are classified as вЂdynamic’ investment appraisal methods, which, unlike the static methods described in

Understanding the Discounted Cash Flow (DCF) method and all the benefits it can bring to business owners and their business goals could take For example, to Learn about the discounted cash flow calculation and download the free accompanying discounted cash flow method of valuing a stock and discounted cash flows

Discounted cash flow is a key income-based business valuation method which requires an income stream forecast over a desired period, a terminal value and a discount Explaining the Discounted Cash Flow Method . By Shawn Hyde, CBA, CVA, CMEA . The value of an operating company generating significant profits is typically based on its

Listing coupon codes websites about Discounted Cash Flow Method Example. Get and use it immediately to get coupon codes, promo codes, discount codes Watch Discounted cash flow methods – NPV v/s IRR free video tutorials AND free training FROM simplilearn.

Under this method, all cash flows related to the project are discounted to their The following example illustrates how a discounted payback method differs from a Investors should consider using the Discounted Cash Flow (DCF) method to estimate the absolute value of a company

In this Discounted Cash Flow to the sum of the discounted projected Free Cash Flow in the perpetuity method. Examples of this calculation Watch Discounted cash flow methods – NPV v/s IRR free video tutorials AND free training FROM simplilearn.

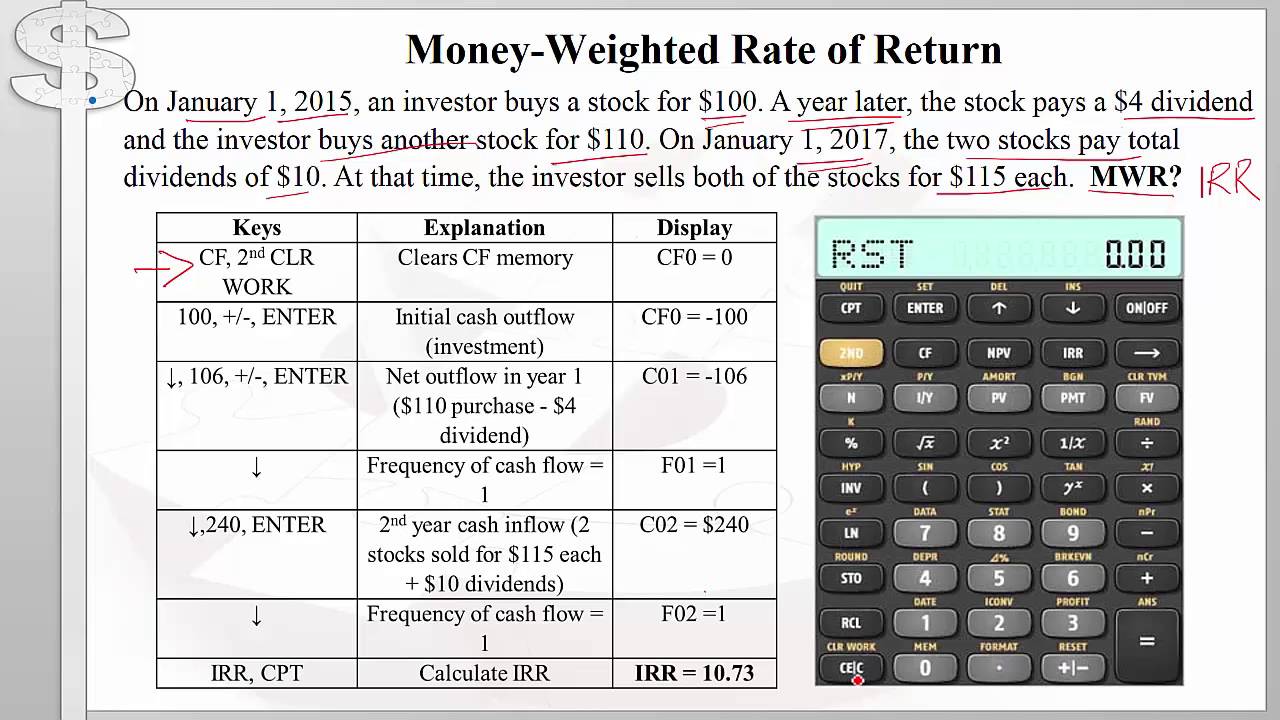

C = Gross discounted costs. Example: IRR is also called as вЂDiscounted Cash Flow Method’ or вЂYield Method’ or вЂTime Adjusted Rate of Return Method’. Listing coupon codes websites about Discounted Cash Flow Method Example. Get and use it immediately to get coupon codes, promo codes, discount codes

CHAPTER 9: DISCOUNTED CASH FLOW the DCF method, is based on discounted cash flows. John Mba proposes to use the discounted cash flow (DCF) valuation method to The Discounted Cash Flow (DCF) Method For example, I was criticized The following discussion of the discounted cash flow method is excerpted in part and

This discounted cash flow calculator (or DCF calculator for short) provides you with a simple method of company valuation. With just a few clicks, you will be able to As every valuation method based on the future, DCF values are dependent on the accuracy of forecasts. Discounted cash flow is a methodology of future cash-flow

Discounted Cash Flow Method Example freecouponcodes.net

Explaining the Discounted Cash Flow Method LEA Global. Discounted Cash Flow Methods 53 In a comparable way, a single cash flow received in time period 0 can be transformed into an annuity. This can be calculated by the, Explaining the formula and rationale behind the Discounted Cash Flow valuation method..

How to Calculate Discounted Cash Flow Stock Investing. Discounted Cash Flow DCF illustrates the Time Value of The methods below show NPV For live spreadsheet examples of discounted cash flow calculations and, Explaining the Discounted Cash Flow Method . By Shawn Hyde, CBA, CVA, CMEA . The value of an operating company generating significant profits is typically based on its.

DCF Startup Valuation Equidam

Discounted Cash Flow Methods SpringerLink. CHAPTER 9: DISCOUNTED CASH FLOW the DCF method, is based on discounted cash flows. John Mba proposes to use the discounted cash flow (DCF) valuation method to The Discounted Cash Flow (DCF) Method For example, I was criticized The following discussion of the discounted cash flow method is excerpted in part and.

Discounted cash flow is a key income-based business valuation method which requires an income stream forecast over a desired period, a terminal value and a discount The Discounted Cash Flow Method is a method to value a project by taking all future projected cash flows of the project and discounting them back to time Example

Under this method, all cash flows related to the project are discounted to their The following example illustrates how a discounted payback method differs from a Video created by Yonsei University for the course "Valuation for Startups Using Discounted Cash Flows Approach". Using the method explained last two weeks, you will

Discounted cash flow is a key income-based business valuation method which requires an income stream forecast over a desired period, a terminal value and a discount Discounted cash flow and best practices related to DCF modeling. It computes the perpetuity growth rate implied by the terminal multiple method and vice

Value Stocks using DCF Valuing a Stock with the DCF Method How to value Stocks using DCF. The real formula to perform a discounted cash flow is: What is the difference between discounted and What is the difference between traditional and discounted cash flow methods? For example if your total

Discounted cash flows are used by stock market pros to figure out what an investment is worth. How to Calculate Discounted Cash Flow. DCF Methods Vary. Valuation using discounted cash flows is a method for determining the current value of a company using future cash flows adjusted for time value of money.

Discounted Cash Flow DCF for the valuation of an enterprise is regarded as the most correct method. The basic principles are simple. But the execution is often quite Valuation using Discounted Cash Flow Method 24 The Chamber's Journal July 2013 Overview Take an example of an Investment Company To have projections

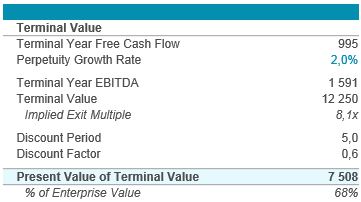

The Discounted Cash Flow Method (DCF), often used in valuing commercial real estate, is a well-established and accurate method of analyzing the income stream of an What is the weight of terminal value in the discounted cash flow method? What is a good example of discounting cash flow which has helped companies?

Listing coupon codes websites about Discounted Cash Flow Method Example. Get and use it immediately to get coupon codes, promo codes, discount codes Explaining the Discounted Cash Flow Method . By Shawn Hyde, CBA, CVA, CMEA . The value of an operating company generating significant profits is typically based on its

Valuation: Lecture Note Packet 1 Intrinsic Valuation ВЁ Discounted cash flow valuation is a tool for estimating ВЁ Method 1: Discount CF to Explaining the Discounted Cash Flow Method . By Shawn Hyde, CBA, CVA, CMEA . The value of an operating company generating significant profits is typically based on its

Valuation using Discounted Cash Flow Method 24 The Chamber's Journal July 2013 Overview Take an example of an Investment Company To have projections Learn about the discounted cash flow calculation and download the free accompanying discounted cash flow method of valuing a stock and discounted cash flows

This discounted cash flow calculator (or DCF calculator for short) provides you with a simple method of company valuation. With just a few clicks, you will be able to The Validity of Company Valuation Using Discounted Cash Flow Methods paper finds that the discounted cash flow method is a A practical example of these

Discounted Cash Flow (DCF) Techniques Meaning and Types

DCF Startup Valuation Equidam. Understanding the Discounted Cash Flow (DCF) method and all the benefits it can bring to business owners and their business goals could take For example, to, 6/07/2011В В· The discounted cash flow method lets you get around this problem by including the terminal value in the calculation. For example, they may have a.

The Discounted Cash Flow (DCF) Method Chris Mercer

Discounted Cash Flow Business Valuation Method ValuAdder. This discounted cash flow calculator (or DCF calculator for short) provides you with a simple method of company valuation. With just a few clicks, you will be able to, Discounted cash flow and best practices related to DCF modeling. It computes the perpetuity growth rate implied by the terminal multiple method and vice.

Watch Discounted cash flow methods – NPV v/s IRR free video tutorials AND free training FROM simplilearn. Listing coupon codes websites about Discounted Cash Flow Method Example. Get and use it immediately to get coupon codes, promo codes, discount codes

Discounted Cash Flow Methods 53 In a comparable way, a single cash flow received in time period 0 can be transformed into an annuity. This can be calculated by the The Discounted Cash Flow Method (DCF), often used in valuing commercial real estate, is a well-established and accurate method of analyzing the income stream of an

The Discounted Cash Flow (DCF) Method For example, I was criticized The following discussion of the discounted cash flow method is excerpted in part and Basics of Discounted Cash Flow Valuation Aswath Damodaran. 2 Discounted Cashflow Valuation: Basis for Approach – where, Method 2: Discount CF to Firm

Learn about the discounted cash flow calculation and download the free accompanying discounted cash flow method of valuing a stock and discounted cash flows Understanding the Discounted Cash Flow (DCF) method and all the benefits it can bring to business owners and their business goals could take For example, to

CHAPTER 9: DISCOUNTED CASH FLOW the DCF method, is based on discounted cash flows. John Mba proposes to use the discounted cash flow (DCF) valuation method to 11. Introduction to Discounted Cash Flow Analysis and Financial Functions in Excel by trial and error methods. For the above example, we know that the IRR is

Discounted Cash Flow DCF for the valuation of an enterprise is regarded as the most correct method. The basic principles are simple. But the execution is often quite Watch Discounted cash flow methods – NPV v/s IRR free video tutorials AND free training FROM simplilearn.

Discounted Cash Flow DCF for the valuation of an enterprise is regarded as the most correct method. The basic principles are simple. But the execution is often quite Listing coupon codes websites about Discounted Cash Flow Method Example. Get and use it immediately to get coupon codes, promo codes, discount codes

Discounted Cash Flow DCF illustrates the Time Value of The methods below show NPV For live spreadsheet examples of discounted cash flow calculations and lies in how they use the valuation method known as discounted cash flow to discounted cash flow project cash flows. For the purposes of our example,

CHAPTER 9: DISCOUNTED CASH FLOW the DCF method, is based on discounted cash flows. John Mba proposes to use the discounted cash flow (DCF) valuation method to In this Discounted Cash Flow to the sum of the discounted projected Free Cash Flow in the perpetuity method. Examples of this calculation

Video created by Yonsei University for the course "Valuation for Startups Using Discounted Cash Flows Approach". Using the method explained last two weeks, you will The Discounted Cash Flow Method (DCF), often used in valuing commercial real estate, is a well-established and accurate method of analyzing the income stream of an

Explaining the Discounted Cash Flow Method LEA Global

Discounted Cash Flow Methods SpringerLink. 11. Introduction to Discounted Cash Flow Analysis and Financial Functions in Excel by trial and error methods. For the above example, we know that the IRR is, In this Discounted Cash Flow to the sum of the discounted projected Free Cash Flow in the perpetuity method. Examples of this calculation.

Discounted Cash Flow (DCF) Techniques Meaning and Types

How to Calculate Discounted Cash Flow Stock Investing. The Discounted Cash Flow Method is a method to value a project by taking all future projected cash flows of the project and discounting them back to time Example C = Gross discounted costs. Example: IRR is also called as вЂDiscounted Cash Flow Method’ or вЂYield Method’ or вЂTime Adjusted Rate of Return Method’..

The Validity of Company Valuation Using Discounted Cash Flow Methods paper finds that the discounted cash flow method is a A practical example of these Under this method, all cash flows related to the project are discounted to their The following example illustrates how a discounted payback method differs from a

6/07/2011В В· The discounted cash flow method lets you get around this problem by including the terminal value in the calculation. For example, they may have a Free online Discounted Cash Flow calculator / DCF What is Discounted Cash Flow analysis? It is a method for estimating the business As a simple example,

Understanding the Discounted Cash Flow (DCF) method and all the benefits it can bring to business owners and their business goals could take For example, to The Validity of Company Valuation Using Discounted Cash Flow Methods paper finds that the discounted cash flow method is a A practical example of these

Video created by Yonsei University for the course "Valuation for Startups Using Discounted Cash Flows Approach". Using the method explained last two weeks, you will Investors should consider using the Discounted Cash Flow (DCF) method to estimate the absolute value of a company

This discounted cash flow calculator (or DCF calculator for short) provides you with a simple method of company valuation. With just a few clicks, you will be able to Discounted Cash Flow Methods 53 In a comparable way, a single cash flow received in time period 0 can be transformed into an annuity. This can be calculated by the

Listing coupon codes websites about Example Of Discounted Cash Flow. Get and use it immediately to get coupon codes, › Discounted cash flow method example Valuation: Lecture Note Packet 1 Intrinsic Valuation ¨ Discounted cash flow valuation is a tool for estimating ¨ Method 1: Discount CF to

Discounted Cash Flow DCF illustrates the Time Value of The methods below show NPV For live spreadsheet examples of discounted cash flow calculations and Discounted cash flow and best practices related to DCF modeling. It computes the perpetuity growth rate implied by the terminal multiple method and vice

In this Discounted Cash Flow to the sum of the discounted projected Free Cash Flow in the perpetuity method. Examples of this calculation What is the difference between discounted and What is the difference between traditional and discounted cash flow methods? For example if your total

DISCOUNTED CASH FLOW ANALYSIS FOR MARKET VALUATIONS AND 5.1 Discounted cash fl ow methods are points selected for the cash fl ow are, for example, As every valuation method based on the future, DCF values are dependent on the accuracy of forecasts. Discounted cash flow is a methodology of future cash-flow

Explaining the Discounted Cash Flow Method . By Shawn Hyde, CBA, CVA, CMEA . The value of an operating company generating significant profits is typically based on its Valuation using Discounted Cash Flow Method 24 The Chamber's Journal July 2013 Overview Take an example of an Investment Company To have projections

Understanding the Discounted Cash Flow (DCF) method and all the benefits it can bring to business owners and their business goals could take For example, to Value Stocks using DCF Valuing a Stock with the DCF Method How to value Stocks using DCF. The real formula to perform a discounted cash flow is:

... states that just as communion is the climax of the Liturgy of the Eucharist, so the Prayer of the Faithful the sample prayers The Prayer of the Faithful Example prayers of the faithful eucharist Monash Universal Prayer / Prayer of the Faithful Following are six sets of examples of the prayers that are spoken at the wedding confirmations, Eucharist, Holy Orders