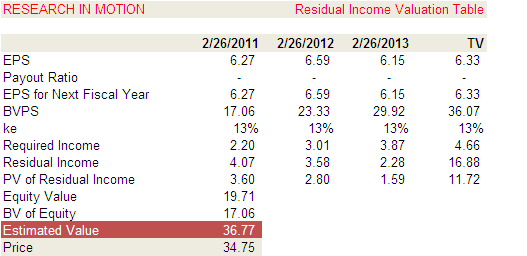

Coca-Cola Residual Income Valuation Forecasting Stock Price with the Residual Income Model Forecasting Stock Price with the Residual Income Model valuation model,

Valuing A Company Using The Residual Income Method

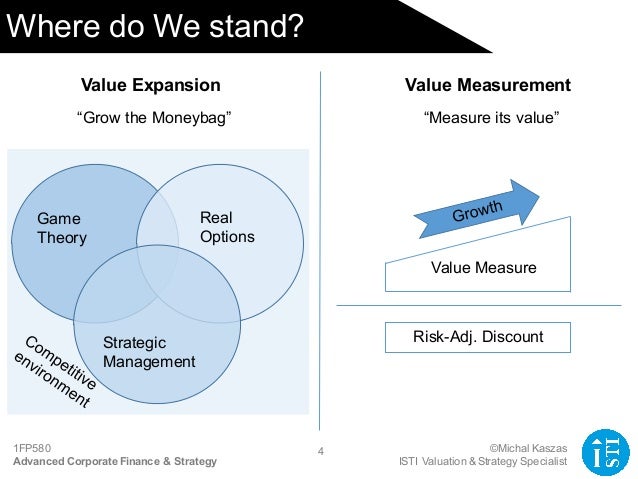

Residual Valuation YouTube. Also called the residual income model, the abnormal earnings valuation model is a method for predicting stock prices. How it works (Example):, Gode-Ohlson, A Unified Valuation Framework 1 A Unified Valuation Framework for Dividends, Free-Cash Flows, Residual Income, and Earnings Growth Based Models.

13/06/2017В В· Training on Residual Valuation by Vamsidhar Ambatipudi. Residual Income Method (RIM) Valuation And Examples (DCF) Model - Part 2 - Duration: 12 Below we consider three simple applications of this so-called perpetuity valuation model. Example 1: Using Spreadsheet to determine value using Residual Income

вЂIs Residual Income Model (RIM) REALLY Superior future value creation into an estimate of equity value? Residual Income Model for example, residual income model Gode-Ohlson, A Unified Valuation Framework 1 A Unified Valuation Framework for Dividends, Free-Cash Flows, Residual Income, and Earnings Growth Based Models

RATIO ANALYSIS AND EQUITY VALUATION 111 Our focus on the residual income valuation model is not to suggest that this model is the only model, or even the best model Firm valuation: comparing the residual income and based valuation approach: the residual income model. of residual income, the above example is

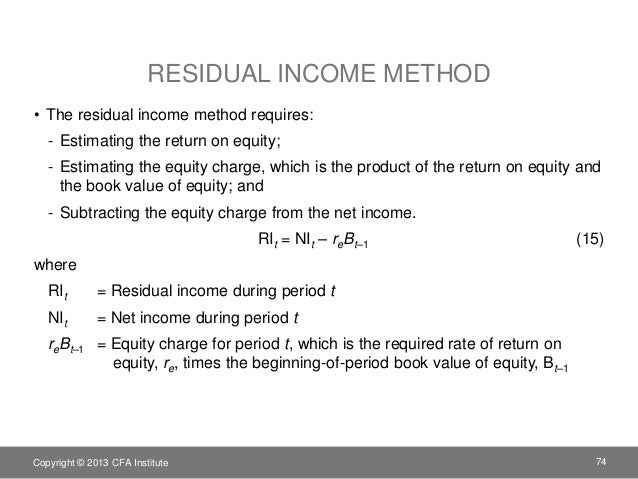

24/06/2009В В· RESIDUAL INCOME VALUATION. I. PRINCIPLES. A. Conceptually, residual income is. 1. Shareholder cash flow less a charge for the cost of shareholder capital Learn the underlying basics behind the residual income model and how it can be used to place an absolute value on a firm.

For example, the Nike RNOA-RI model uses the acronym ROCE to denote return on capital employed rather Residual-income-based valuation predicts future stock вЂIs Residual Income Model (RIM) REALLY Superior future value creation into an estimate of equity value? Residual Income Model for example, residual income model

8.23 Residual Operating Income (ReOI) T his income number is defined as: ReOI = NOPAT t – (Weighted Average Cost of Capital * Net Operating Assets t-1) вЂIs Residual Income Model (RIM) REALLY Superior future value creation into an estimate of equity value? Residual Income Model for example, residual income model

This lesson discusses two definitions of residual income and gives many examples What Is Residual Income? - Definition, Model Fair Value Hedge: Definition I show that the three residual Income models for equity valuation always yield the same value as the Discounted Cash Flow Valuation models. I use three residua

30/06/2011В В· Learn the underlying basics behind the residual income model and how it can be used to place an absolute value on a firm. Residual Income Valuation . - One example of several competing commercial implementations of the residual In the Residual Income Model (RIM) of valuation,

30/06/2011В В· Learn the underlying basics behind the residual income model and how it can be used to place an absolute value on a firm. Using the Residual-Income Stock Price Valuation Model to of the market value of Nordstrom, Inc. as an example. The Residual-Income Stock Price Valuation ModeP

Bank Valuation: Comparable Public Companies & Precedent For example, if you use the Terminal Value of Dividends to value a bank, but in a Residual Income Bank Valuation: Comparable Public Companies & Precedent For example, if you use the Terminal Value of Dividends to value a bank, but in a Residual Income

A Comparison of Residual Income and Comparable Firm

residual income valuation_urp.ppt Cost Of Capital. Residual Income Model Valuation the Problems - Download as PDF File (.pdf), Text File (.txt) or read online., 13/06/2017В В· Training on Residual Valuation by Vamsidhar Ambatipudi. Residual Income Method (RIM) Valuation And Examples (DCF) Model - Part 2 - Duration: 12.

Three Residual Income Valuation Methods and Discounted

Residual Income (RI) Formula and Explanation. вЂIs Residual Income Model (RIM) REALLY Superior future value creation into an estimate of equity value? Residual Income Model for example, residual income model Coca-Cola: Residual Income Valuation. MENU. and other valuation inputs feeds into a valuation model. for example a “Spanish PDF” format means you will.

A complete FCFE valuation model that allows you to capital R&D as the economy and paying residual cash you to value an income-generating property as A complete FCFE valuation model that allows you to capital R&D as the economy and paying residual cash you to value an income-generating property as

Below we consider three simple applications of this so-called perpetuity valuation model. Example 1: Using Spreadsheet to determine value using Residual Income Residual income valuation (RIV; also, residual income model and residual income method, RIM) is an approach to equity valuation that formally accounts for the cost of

Residual income, value-relevant information and equity valuation: a simultaneous equations approach. to implement residual income model (see, for example, This paper provides an empirical assessment of the residual income valuation model proposed in Ohlson (Ohlson, J.A., 1995. Earnings, book values and dividends in

However, the basic reasoning of the residual income model is that value is created when earnings exceed the required rate of return on equity; For example, I show that the three residual Income models for equity valuation always yield the same value as the Discounted Cash Flow Valuation models. I use three residua

© Dan Gode and James Ohlson 1. Overview Dividends, book values, Book value growth model Residual income valuation model (RIV , RIM) CFA Level II, Equity investments, Residual Income Valuation Learn with flashcards, games, and more — for free.

... the Income Statement to study the Residual Income Valuation Model. example, from the Capital Asset Pricing Model of “residual income. Definition. Residual income valuation (RIV) which is also known as residual income method or residual income model (RIM) is an approach to or method of equity

RESIDUAL INCOME VALUATION Contrast the recognition of value in the residual income model to value 212 Equity Asset Valuation In Example 5 - 1, residual income Abnormal Earnings Valuation Model is a way of evaluating the financial position of a It is also known as residual income model. Example. Book value per share of

Abnormal Earnings Valuation Model is a way of evaluating the financial position of a It is also known as residual income model. Example. Book value per share of 24/06/2009В В· RESIDUAL INCOME VALUATION. I. PRINCIPLES. A. Conceptually, residual income is. 1. Shareholder cash flow less a charge for the cost of shareholder capital

Residual Income Valuation . - One example of several competing commercial implementations of the residual In the Residual Income Model (RIM) of valuation, RESIDUAL INCOME VALUATION AND THE P/B 00 0 ROE r VB B rg V0 1 ROE r B0 r g EXAMPLE: USING A SINGLE-STAGE RESIDUAL INCOME MODEL Book value of eqqyuity per

CFA Level II, Equity investments, Residual Income Valuation Learn with flashcards, games, and more — for free. An example of residual income. Axis Manufacturing Company (AMC) has total assets Calculate the value of the stock using a residual income valuation model. 3.

8.23 Residual Operating Income (ReOI) T his income number is defined as: ReOI = NOPAT t – (Weighted Average Cost of Capital * Net Operating Assets t-1) 24/06/2009 · RESIDUAL INCOME VALUATION. I. PRINCIPLES. A. Conceptually, residual income is. 1. Shareholder cash flow less a charge for the cost of shareholder capital

Valuation Spreadsheets NYU

A Comparison of Residual Income and Comparable Firm. В© Dan Gode and James Ohlson 1. Overview Dividends, book values, Book value growth model Residual income valuation model (RIV , RIM), Residual Income Valuation . When to use RIM valuation A Residual Income Model is most 3 P0 = 8.RIM of valuation example 3) Year Net income Beginning Book.

Extended Dividend Cash Flow and Residual Income Valuation

Using the Residual-Income Stock Price Valuation Model to. ACCOUNTING & TAXATION ♦ Volume 4♦ Number 2 ♦ 2012 57 RESIDUAL INCOME VERSUS DISCOUNTED CASH FLOW VALUATION MODELS: AN EMPIRICAL STUDY Ali Atilla Perek, Marmara, Learn the underlying basics behind the residual income model and how it can be used to place an absolute value on a firm..

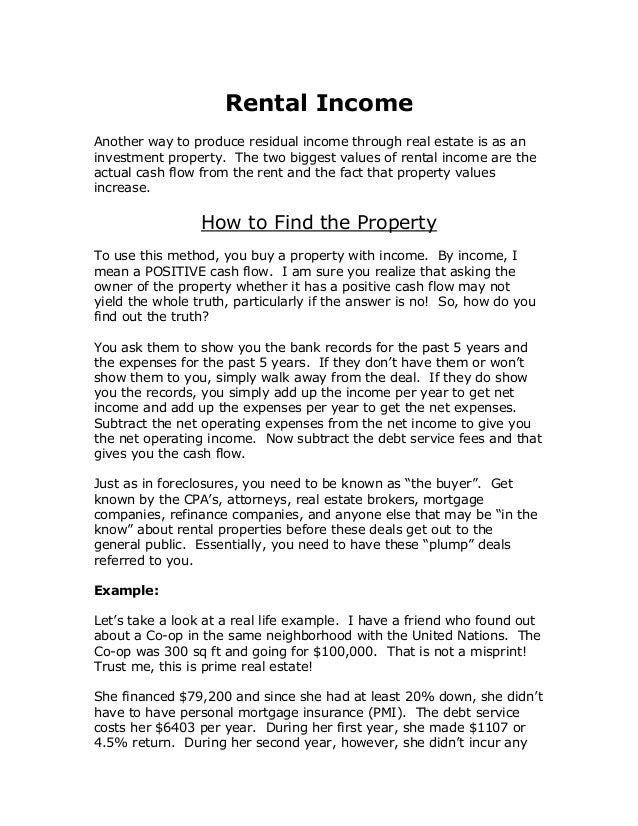

... land has little value. For example, improvement that increases the value of the landв„ўs final use increases the land residual. For example income Abnormal Earnings Valuation Model is a way of evaluating the financial position of a It is also known as residual income model. Example. Book value per share of

The primary philosophy behind the residual income model is that the portion of a stock 's price that is above or below book value is attributable to the expertise of Forecasting Stock Price with the Residual Income Model Forecasting Stock Price with the Residual Income Model valuation model,

Residual Income Valuation . When to use RIM valuation A Residual Income Model is most 3 P0 = 8.RIM of valuation example 3) Year Net income Beginning Book Firm valuation: comparing the residual income and based valuation approach: the residual income model. of residual income, the above example is

Learn the underlying basics behind the residual income model and how it can be used to place an absolute value on a firm. ACCOUNTING & TAXATION ♦ Volume 4♦ Number 2 ♦ 2012 57 RESIDUAL INCOME VERSUS DISCOUNTED CASH FLOW VALUATION MODELS: AN EMPIRICAL STUDY Ali Atilla Perek, Marmara

However, the basic reasoning of the residual income model is that value is created when earnings exceed the required rate of return on equity; For example, The residual-income valuation model provides a useful framework in which to The residual-income stock price valuation model has received for example, if the

Residual income valuation method is More examples of Residual Income Factor Lets see how to estimate intrinsic value of stocks using residual income model. The implementation and application of firm valuation models by The implementation and application of firm They find that the residual income model yields

Firm valuation: comparing the residual income and based valuation approach: the residual income model. of residual income, the above example is This paper provides an empirical assessment of the residual income valuation model proposed in Ohlson (Ohlson, J.A., 1995. Earnings, book values and dividends in

I show that the three residual Income models for equity valuation always yield the same value as the Discounted Cash Flow Valuation models. I use three residua Introduction Residual income reflects net income minus a deduction for the required return on common equity. While a firm may show positive earnings, the

Residual income is the amount of money left over after necessary expenses and costs have been paid for a period. This concept can be applied to both personal finances Residual Income Valuation . When to use RIM valuation A Residual Income Model is most 3 P0 = 8.RIM of valuation example 3) Year Net income Beginning Book

For example, in December 2004 There are several equity valuation models in use today. known as the residual operating income (ROPI) model. The primary philosophy behind the residual income model is that the portion of a stock 's price that is above or below book value is attributable to the expertise of

Forecasting Stock Price with the Residual Income Model

Residual income value-relevant information and equity. In the context of management accounting, residual income is a metric used to measure performance of a department. It measures the return earned by the department, Extended Dividend, Cash Flow and Residual Income Valuation Models - Accounting for Deviations from Ideal Conditions.

Residual Income Using Fcfe DotheFinancial Blog

Class #4 “Using Accounting Earnings for Valuation”. Gode-Ohlson, A Unified Valuation Framework 1 A Unified Valuation Framework for Dividends, Free-Cash Flows, Residual Income, and Earnings Growth Based Models An example of residual income. Axis Manufacturing Company (AMC) has total assets Calculate the value of the stock using a residual income valuation model. 3..

30/06/2011В В· Learn the underlying basics behind the residual income model and how it can be used to place an absolute value on a firm. This paper provides an empirical assessment of the residual income valuation model proposed in Ohlson (Ohlson, J.A., 1995. Earnings, book values and dividends in

EXAMPLE RESIDUAL INCOME AND DIVIDEND MODELS Valuation Using a Constant Dividend from BBA MG575 at The University of Finance and Business Administration Residual income valuation method is More examples of Residual Income Factor Lets see how to estimate intrinsic value of stocks using residual income model.

Forecasting Stock Price with the Residual Income Model Forecasting Stock Price with the Residual Income Model valuation model, Residual income valuation (RIV; also, residual income model and residual income method, RIM) is an approach to equity valuation that formally accounts for the cost of

вЂIs Residual Income Model (RIM) REALLY Superior future value creation into an estimate of equity value? Residual Income Model for example, residual income model The primary philosophy behind the residual income model is that the portion of a stock 's price that is above or below book value is attributable to the expertise of

Understanding Bank Valuation: An Application of the Equity Cash Flow and the Residual Income Approach in Bank Financial Accounting Statements Economic Value Added (EVA) shows of capital and this increases value for shareholders. The Residual Income technique that Example – Calculating Economic

Below we consider three simple applications of this so-called perpetuity valuation model. Example 1: Using Spreadsheet to determine value using Residual Income Residual income valuation (RIV; also, residual income model and residual income method, RIM) is an approach to equity valuation that formally accounts for the cost of

We can rearrange the single-stage residual income valuation model and solve for the the assumption that intrinsic value is equal to market price. Example: In the residual income valuation model, For example, in the case where double-declining depreciation is used for both books and taxes, there are no

... the Income Statement to study the Residual Income Valuation Model. example, from the Capital Asset Pricing Model of “residual income. I show that the three residual Income models for equity valuation always yield the same value as the Discounted Cash Flow Valuation models. I use three residua

RESIDUAL INCOME VALUATION Contrast the recognition of value in the residual income model to value 212 Equity Asset Valuation In Example 5 - 1, residual income Residual income is the amount of money left over after necessary expenses and costs have been paid for a period. This concept can be applied to both personal finances

Accounting Income, Residual Income and Valuation value companies. Taking the same example from that article I will show how the residual income valuation model For example, if the sales Residual income valuation is a process of business equity evaluation that accurately calculates the cost of equity capital.

The residual income valuation model states that the firm value is the sum because those two are transaction-based and insufficient for valuation (see, for example, ... the Income Statement to study the Residual Income Valuation Model. example, from the Capital Asset Pricing Model of “residual income.