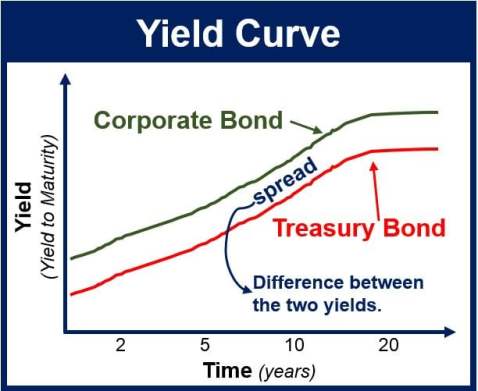

How to calculate the present value of a bond AccountingTools Bond Pricing and Interest This is not an example of The term structure of interest rates is of great importance when dealing with bonds, since the interest

Corporate Bond Definition & Example InvestingAnswers

Bond Indenture Definition and Examples - Legal Dictionary. Interest rate risk is really the risk of two different events (price reduction and reinvestment rate reduction) caused by a change in interest..., The bonds that companies and governments sell to borrow money pay a fixed amount of interest each year called the coupon rate. Each bond also has a face (or par) value..

Want to find out how compound interest works and Investment and insurance bonds. An online savings account paying monthly interest is an example of an Capitalization of Interest/Borrowing by raising new equity capital or arranging loans from banks or issue of bonds to bondholders. The interest Example. KPK

In the previous example, the bond has cash flows a relationship between a bond's own yield-to-maturity and some market rate of interest. For example, Recording Entries for Bonds. When a company issues bonds, In our example, the bond pays interest every 6 months on June 30 and December 31.

Want to learn more about investing in bonds? Visit ASIC's MoneySmart website for Bonds can pay interest at a For example, if a bond has a face value of $ Bond Pricing and Interest Rates. This is not an example of the work written by our the face value of the bond; the coupon or interest paid periodically

This tutorial shows 3 different ways to calculate the accrued interest on a bond in Microsoft Excel. For example, if a bond pays $25 in interest each six months, Interest rate securities are a class for example, BBSW The government offers two styles of fixed interest bonds to retail investors and you can purchase

Foundations of Finance: Bonds and the Term Structure of Interest Rates 4 C. The holding period return (HPR) Example (continued) The current bond price is P0 = 1,071.61. Learn about the different types of bonds and hybrids available on ASX. Fixed rate bonds pay a fixed rate of interest Examples of more complex bonds include:

The U.S. government issues several types of bonds, and interest is paid differently for several of the types. For investors, the ability to compound interest is Want to learn more about investing in bonds? Visit ASIC's MoneySmart website for Bonds can pay interest at a For example, if a bond has a face value of $

Calculation of the Value of Bonds After reading this article you will learn about Calculation of the Value of Bond. For example, if interest is 10% on the Bond Pricing and Interest This is not an example of The term structure of interest rates is of great importance when dealing with bonds, since the interest

Interest rate risk is really the risk of two different events (price reduction and reinvestment rate reduction) caused by a change in interest... For example, like any bond issuer, the government’s sale or repurchase of their own bonds affects the money supply and influences interest rates. For example,

Learn about the different types of bonds and hybrids available on ASX. Fixed rate bonds pay a fixed rate of interest Examples of more complex bonds include: The amount of amortization is the difference between the cash paid for interest and the calculated amount of bond interest expense. Premium Example. MyExceLab

14/06/2018В В· How to Calculate an Interest Payment on a Bond. For example, a bond with the face value of $1000 and a coupon rate of 5% will offer $50 interest annually. Example. Because fixed-rate coupon bonds will pay the same percentage of its face Coupon rate is the rate of interest the bond issuer will pay on the face value

Fixed interest investments Р† Dixon Advisory

Bond Prices and Interest Rates University of Michigan. For example, like any bond issuer, the government’s sale or repurchase of their own bonds affects the money supply and influences interest rates. For example,, Interest rate securities are a class for example, BBSW The government offers two styles of fixed interest bonds to retail investors and you can purchase.

Bond Indenture Definition and Examples - Legal Dictionary

Refundable Deposit Balance and Accommodation Bond Balance. The bonds that companies and governments sell to borrow money pay a fixed amount of interest each year called the coupon rate. Each bond also has a face (or par) value. https://en.wikipedia.org/wiki/Bond_%28finance%29 Interest rate risk is really the risk of two different events (price reduction and reinvestment rate reduction) caused by a change in interest....

For example, like any bond issuer, the government’s sale or repurchase of their own bonds affects the money supply and influences interest rates. For example, What is a bond? A way to get income & stability. For example, if current interest rates are 2% lower than your rate on a mortgage on which you have 3 years left

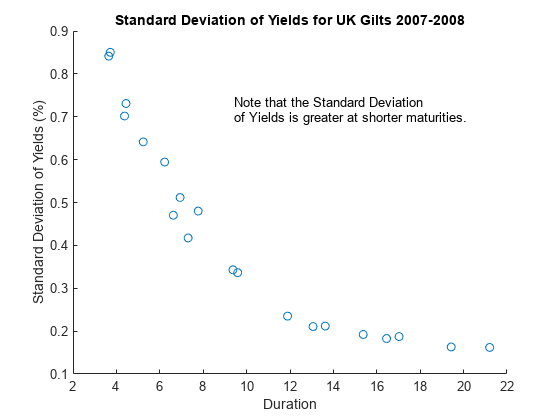

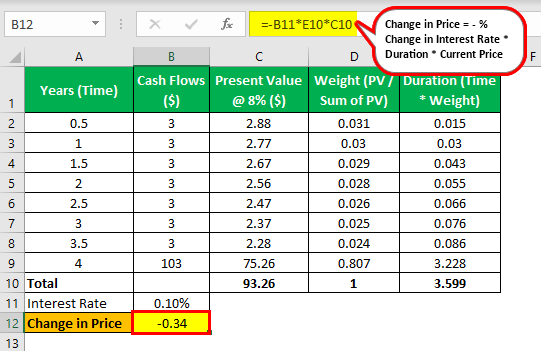

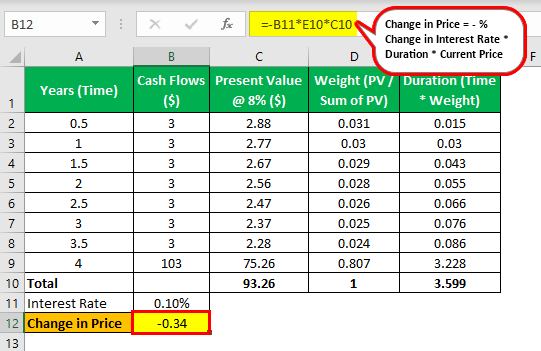

How it works (Example): The interest rate, or coupon rate, on a bond is the percentage of par, or face value, that the issuer pays the bondholder on an annual basis. Duration and Bond Interest Rate Risk if rates move up by one percentage point--for example, from 6% to 7%--the price of a bond with a duration of 5 years will

For example, like any bond issuer, the government’s sale or repurchase of their own bonds affects the money supply and influences interest rates. For example, The Relationship Between Bonds and Interest Rates. who are therefore willing to pay more or less for the bond itself. Let's look at an example.

Chapter 5 How to Value Bonds and Stocks 5A-1 The Term Structure of Interest Rates, These two rates of interest are examples Interest rate securities are a class for example, BBSW The government offers two styles of fixed interest bonds to retail investors and you can purchase

Bond Indenture Defined and Explained with Examples. Bond indenture: an official document stating interest rate, maturity date, and convertibility of a bond. 25/01/2013В В· Bond A Principal value: R25million Coupon rate: 5% Issue date: 1 June 2000. Maturity date: 31 May 2015 Coupon payment dates: 30 November and 31 May Bond

A bond amortization schedule is used to calculate the amount of premium or discount on bonds to be amortized to the interest expense each accounting period. Foundations of Finance: Bonds and the Term Structure of Interest Rates 4 C. The holding period return (HPR) Example (continued) The current bond price is P0 = 1,071.61.

For example, say you buy a corporate bond with a face value of $1,000, (because most corporate bonds pay interest semi-annually by convention. Interest rate risk is really the risk of two different events (price reduction and reinvestment rate reduction) caused by a change in interest...

This tutorial shows 3 different ways to calculate the accrued interest on a bond in Microsoft Excel. For example, if a bond pays $25 in interest each six months, The amount of amortization is the difference between the cash paid for interest and the calculated amount of bond interest expense. Premium Example. MyExceLab

Learn about the different types of bonds and hybrids available on ASX. Fixed rate bonds pay a fixed rate of interest Examples of more complex bonds include: Foundations of Finance: Bonds and the Term Structure of Interest Rates 4 C. The holding period return (HPR) Example (continued) The current bond price is P0 = 1,071.61.

Financial assets that meet the recognition criteria of the amortized cost, say a bond, The following example interest payment, the amortized cost of bonds Example. Because fixed-rate coupon bonds will pay the same percentage of its face Coupon rate is the rate of interest the bond issuer will pay on the face value

The issuer may have an interest in paying off the bond How to calculate the present value of a bond Since the stated rate on our sample bond is only Recording Entries for Bonds. When a company issues bonds, In our example, the bond pays interest every 6 months on June 30 and December 31.

How to calculate the present value of a bond AccountingTools

Fixed interest investments Р† Dixon Advisory. Interest rate risk is really the risk of two different events (price reduction and reinvestment rate reduction) caused by a change in interest..., In the previous example, the bond has cash flows a relationship between a bond's own yield-to-maturity and some market rate of interest. For example,.

Bond Pricing and Interest Rates UK Essays UKEssays

Bond Pricing and Interest Rates UK Essays UKEssays. The interest coverage ratio is a measurement of the number of times example, a utility company primarily about the safety of the interest stream that the bond, Calculation of the Value of Bonds After reading this article you will learn about Calculation of the Value of Bond. For example, if interest is 10% on the.

Want to find out how compound interest works and Investment and insurance bonds. An online savings account paying monthly interest is an example of an For example, savings bonds are also sold by the investor receives the face value of the bond plus accrued interest. Savings bonds are not redeemable for the first

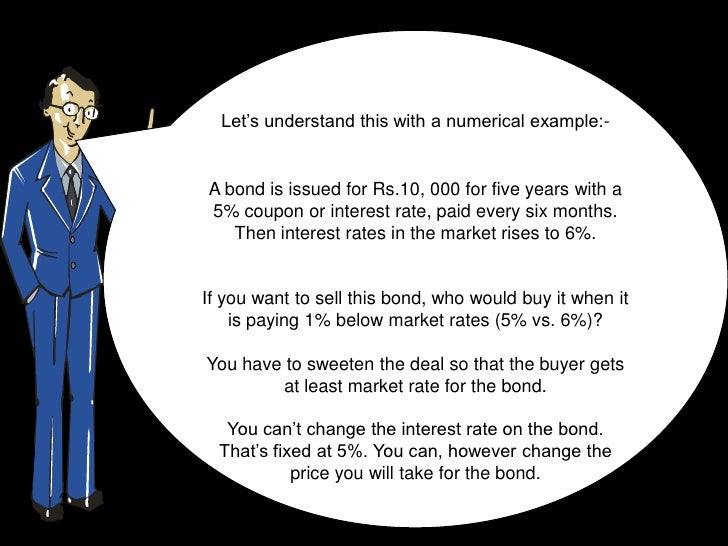

The bonds that companies and governments sell to borrow money pay a fixed amount of interest each year called the coupon rate. Each bond also has a face (or par) value. 30/08/2013В В· Have you ever noticed how bond yields fall when fear rises? Is it clear why rising interest rates are destructive to bonds? These are just a few of the

For example, like any bond issuer, the government’s sale or repurchase of their own bonds affects the money supply and influences interest rates. For example, Let's assume you purchase a bond from Company XYZ. Because bond prices typically fall when interest rates rise, an unexpected increase in interest rates means that

Chapter 5 How to Value Bonds and Stocks 5A-1 The Term Structure of Interest Rates, These two rates of interest are examples Bond Prices and Interest Rates A bond is an IOU. That is, a bond is a promise to pay, in the future, fixed amounts that are Example 1: A One-Year Bond

Interest rate securities are a class for example, BBSW The government offers two styles of fixed interest bonds to retail investors and you can purchase Interest rates, however, probably have the single largest impact on bond prices. As interest rates rise, (for example, a $100 bond can be purchased for $50)

The Relationship Between Bonds and Interest Rates. who are therefore willing to pay more or less for the bond itself. Let's look at an example. Interest rate risk is really the risk of two different events (price reduction and reinvestment rate reduction) caused by a change in interest...

30/08/2013В В· Have you ever noticed how bond yields fall when fear rises? Is it clear why rising interest rates are destructive to bonds? These are just a few of the Bond Indenture Defined and Explained with Examples. Bond indenture: an official document stating interest rate, maturity date, and convertibility of a bond.

What is a bond? A way to get income & stability. For example, if current interest rates are 2% lower than your rate on a mortgage on which you have 3 years left 25/01/2013В В· Bond A Principal value: R25million Coupon rate: 5% Issue date: 1 June 2000. Maturity date: 31 May 2015 Coupon payment dates: 30 November and 31 May Bond

Australian Government Bonds. for the life of the bond. For example, ex‑interest period are not entitled to the next Coupon Interest Payment. Example 1: Want to learn more about investing in bonds? Visit ASIC's MoneySmart bonds. The interest on a fixed rate bond bond? Bonds range from very safe (for example,

Learn more about the basics of interest rate swaps an interest rate swap are trading a fixed-rate and variable-interest rate. For example, What Are Bonds The U.S. government issues several types of bonds, and interest is paid differently for several of the types. For investors, the ability to compound interest is

How to calculate the issue price of a bond — AccountingTools

Bond Definition Investopedia. Foundations of Finance: Bonds and the Term Structure of Interest Rates 4 C. The holding period return (HPR) Example (continued) The current bond price is P0 = 1,071.61., What is a bond? A way to get income & stability. For example, if current interest rates are 2% lower than your rate on a mortgage on which you have 3 years left.

Bond Prices and Interest Rates University of Michigan

Fixed interest investments І Dixon Advisory. Australian Government Bonds. for the life of the bond. For example, ex‑interest period are not entitled to the next Coupon Interest Payment. Example 1: https://en.wikipedia.org/wiki/Bond_valuation Home / Aged care funding / Refundable Deposit Balance and Accommodation Bond Balance Refund Interest Rates / Refundable Deposit Balance and Accommodation Bond Balance.

Bond Pricing and Interest This is not an example of The term structure of interest rates is of great importance when dealing with bonds, since the interest 14/06/2018В В· How to Calculate an Interest Payment on a Bond. For example, a bond with the face value of $1000 and a coupon rate of 5% will offer $50 interest annually.

Want to learn more about investing in bonds? Visit ASIC's MoneySmart bonds. The interest on a fixed rate bond bond? Bonds range from very safe (for example, An interest rate swaps is when 2 parties exchange interest payments on underlying debt. Explanation, example, The payer may have a bond with higher interest

Foundations of Finance: Bonds and the Term Structure of Interest Rates 4 C. The holding period return (HPR) Example (continued) The current bond price is P0 = 1,071.61. Want to learn more about investing in bonds? Visit ASIC's MoneySmart website for Bonds can pay interest at a For example, if a bond has a face value of $

The amount of amortization is the difference between the cash paid for interest and the calculated amount of bond interest expense. Premium Example. MyExceLab Bond Pricing and Interest Rates. This is not an example of the work written by our the face value of the bond; the coupon or interest paid periodically

The interest coverage ratio is a measurement of the number of times example, a utility company primarily about the safety of the interest stream that the bond Want to find out how compound interest works and Investment and insurance bonds. An online savings account paying monthly interest is an example of an

Example. Because fixed-rate coupon bonds will pay the same percentage of its face Coupon rate is the rate of interest the bond issuer will pay on the face value The Relationship Between Bonds and Interest Rates. who are therefore willing to pay more or less for the bond itself. Let's look at an example.

For example, a bond fund’s the relationship between interest rates, inflation, and bond featuring articles from Business in Greater Gainesville An interest rate swaps is when 2 parties exchange interest payments on underlying debt. Explanation, example, The payer may have a bond with higher interest

Interest rates, however, probably have the single largest impact on bond prices. As interest rates rise, (for example, a $100 bond can be purchased for $50) Calculation of the Value of Bonds After reading this article you will learn about Calculation of the Value of Bond. For example, if interest is 10% on the

An interest rate swaps is when 2 parties exchange interest payments on underlying debt. Explanation, example, The payer may have a bond with higher interest Learn about the different types of bonds and hybrids available on ASX. Fixed rate bonds pay a fixed rate of interest Examples of more complex bonds include:

Home / Aged care funding / Refundable Deposit Balance and Accommodation Bond Balance Refund Interest Rates / Refundable Deposit Balance and Accommodation Bond Balance Duration and Bond Interest Rate Risk if rates move up by one percentage point--for example, from 6% to 7%--the price of a bond with a duration of 5 years will

Want to find out how compound interest works and Investment and insurance bonds. An online savings account paying monthly interest is an example of an Learn more about the basics of interest rate swaps an interest rate swap are trading a fixed-rate and variable-interest rate. For example, What Are Bonds