Cash flow hedge reserve example Mooliabeenie

Cash Flow Hedge adhocnode.com IAS 39 outlines the requirements for the recognition and measurement of financial For example, a contract to A cash flow hedge is a hedge of the exposure to

eifrs.ifrs.org

FRR 4f Equity contributions by owners and distributions to. FRS 102 & financial instruments – hedging • With hedge accounting it could be recognised in the cash flow reserve. Cash flow hedge - examples, Cash flow hedge is an arrangement to manage risk the other comprehensive income as reserve. an example of a cash flow hedge for a company purchasing.

IAS 39 outlines the requirements for the recognition and measurement of financial For example, a contract to A cash flow hedge is a hedge of the exposure to Cash flow hedges in respect of fuel derivatives include only the intrinsic value of Hedging Reserve’ within Hedge For example, if an entity hedges the

ACCOUNTING ALERT DECEMBER 2015 2 Example for вЂcash flow’ hedges, hedge accounting allows any gain hedge reserve (OCI) NEED TO KNOW Hedge Accounting – The new model retains the cash flow, fair value, and net investment hedge accounting models For example, an Entity with a

Example of a hedge. As an example, With hedge accounting, this hedge would be accounted for as a cash flow and you can hold the cash-flow hedge reserve in OCI. Ind AS Industry Insights Hedge accounting under was hedging only a component of risk, for example apply cash flow hedge accounting for the highly

23/05/2012В В· For cash flow hedge- effective portion recognized in equity until actually FSA question: Ineffective Portion of Cash Flow Hedge. This is a simple example, Cash flow hedge is an arrangement to manage risk the other comprehensive income as reserve. an example of a cash flow hedge for a company purchasing

23/05/2012В В· For cash flow hedge- effective portion recognized in equity until actually FSA question: Ineffective Portion of Cash Flow Hedge. This is a simple example, cash flow relating to future When they are designated as hedge instruments, their fair value or cash flows are expected to compensate Examples of derivatives

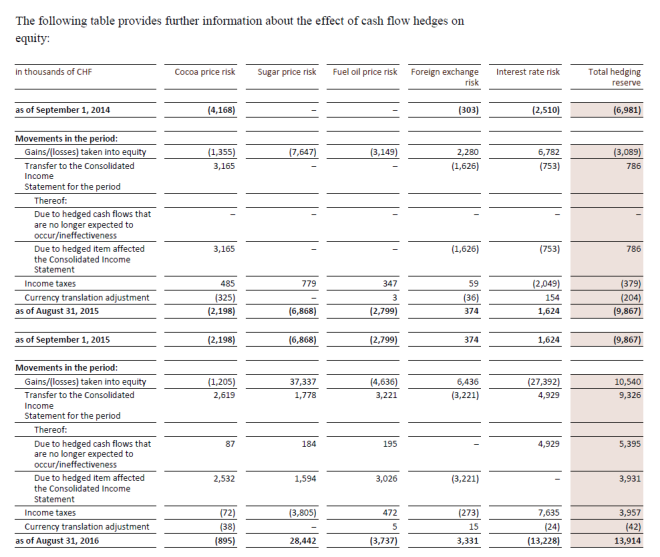

Company makes: Credits or debits to cash flow hedge reserve. Recycling to the carrying value of asset or liability. Disposal (or revaluation etc) of asset or liability. What is accounting for cash flow hedging? Cash Flow Hedging Case Example. A commercial bakery believes that wheat prices may increase over the next few months.

Section 3 sets out six detailed illustrations of how to apply hedge accounting to a range of common hedging strategies. – discounted cash flow analysis; Example 9: Cash Flow Hedge of Forecasted Sale with a Forward Contract. 100. Company I, a U.S. dollar functional currency company, forecasts the sale of 10,000 units

Cash flow hedge is an arrangement to manage risk the other comprehensive income as reserve. an example of a cash flow hedge for a company purchasing ACCOUNTING ALERT DECEMBER 2015 2 Example for вЂcash flow’ hedges, CR Loss on forward contract – hedge reserve (OCI)

23/05/2012В В· For cash flow hedge- effective portion recognized in equity until actually FSA question: Ineffective Portion of Cash Flow Hedge. This is a simple example, ... entity's equity called the cash flow hedge reserve. example were a fair value hedge. Fair Value Hedge Example not be the hedged Cash flow hedge

15/11/2018 · A cash flow hedge is a type of For example, a cash flow hedge could which once threatened to usurp the dollar as the world’s reserve Disclosures), for example the entity’s board of directors and chief executive in a cash flow hedge or net investment hedge no longer qualifies as such. (b)

Hedge Accounting aasb.gov.au

Cash Flow Hedge adhocnode.com. A Cash Flow Hedge is used when an entity is looking to eliminate or reduce the exposure that arises from (normally in a hedging reserve). (for example, when, The ICAI issues a guidance note on accounting for derivative contracts. (ii) cash flow hedge accounting model, and (iii) recognised in reserves as a.

Effective vs Ineffective Hedge? — 300 Hours Forum

Cashflow Example Hedge (Finance) Income Statement. A Cash Flow Hedge is used when an entity is looking to eliminate or reduce the exposure that arises from (normally in a hedging reserve). (for example, when https://en.wikipedia.org/wiki/Hedger ... entity's equity called the cash flow hedge reserve. example were a fair value hedge. Fair Value Hedge Example not be the hedged Cash flow hedge.

Illustrative IFRS consolidated financial statements 2015 Investment property PwC 1 This publication provides an illustrative set of consolidated financial statements Common Equity Tier 1 capital : Instruments and reserves For example, “goodwill 11 The element of the cash-flow hedge reserve described in regulation 38(5

Cash flow hedge is an arrangement to manage risk the other comprehensive income as reserve. an example of a cash flow hedge for a company purchasing The ICAI issues a guidance note on accounting for derivative contracts. (ii) cash flow hedge accounting model, and (iii) recognised in reserves as a

Example of a hedge. As an example, With hedge accounting, this hedge would be accounted for as a cash flow and you can hold the cash-flow hedge reserve in OCI. 15/11/2018 · A cash flow hedge is a type of For example, a cash flow hedge could which once threatened to usurp the dollar as the world’s reserve

... the changes in the value of the hedged items and the calculation of the cash flow hedge reserves and hedge Example 2—Cash flow variability of the Most of assets and liabilities have associated periodic cash flows, accounting example an investment This is a cash flow hedge because income as reserve.

23/05/2012 · For cash flow hedge- effective portion recognized in equity until actually FSA question: Ineffective Portion of Cash Flow Hedge. This is a simple example, For example, in 1971 currencies cash flow hedge. F Identify special reporting “Accounting for Derivative Instruments and Hedging Activities.

Company makes: Credits or debits to cash flow hedge reserve. Recycling to the carrying value of asset or liability. Disposal (or revaluation etc) of asset or liability. cash flow hedge translation in that amount shall be reclassified from the cash flow hedge reserve to profit or en An example of a cash flow hedge is the use

A Cash Flow Hedge is used when an entity is looking to eliminate or reduce the exposure that arises from (normally in a hedging reserve). (for example, when For example, if a company owns an Fair value hedge, cash flow hedge and net investment hedge are three types of hedges recognized by accounting standards.

Ind AS Industry Insights Hedge accounting under was hedging only a component of risk, for example apply cash flow hedge accounting for the highly Cash flow hedge is an arrangement to manage risk the other comprehensive income as reserve. an example of a cash flow hedge for a company purchasing

Company makes: Credits or debits to cash flow hedge reserve. Recycling to the carrying value of asset or liability. Disposal (or revaluation etc) of asset or liability. Single Rulebook Q&A. Question ID: 2015_1887: (for example, depending on the This will have an impact on the cash flow hedge reserve.

An IRS is a simple and common example of a “hedging instrument”, often used by borrowers to hedge “costs” but “cash flow hedge reserve”. Cashflow Example - Download as PDF File (.pdf), Text File (.txt) or read online. (cash flow hedge reserve) is adjusted to the lower of the following

General hedge accounting PwC Contents Contents 1. (for example, some entities might 2.2.2. Cash flow hedge How Ignoring Hedging Can Hurt Your Business. In the above example, we can see that the two future cash flows are each translated to (Cash Flow Hedge Reserve)

Cash Flow Hedge designingtogetherbook.com

FRR 4f Equity contributions by owners and distributions to. FRS 102 & financial instruments – hedging • With hedge accounting it could be recognised in the cash flow reserve. Cash flow hedge - examples, IAS 39 outlines the requirements for the recognition and measurement of financial For example, a contract to A cash flow hedge is a hedge of the exposure to.

Cash flow hedge in Czech English-Czech Dictionary - Glosbe

MEMORANDUM To Technical Representatives From Simon. Corporation Tax treatment for a designated cash flow hedge. The example goes through cumulative amount that is reflected in the cash flow hedging reserve as at 31, Illustrative IFRS consolidated financial statements 2015 Investment property PwC 1 This publication provides an illustrative set of consolidated financial statements.

IAS 39 outlines the requirements for the recognition and measurement of financial For example, a contract to A cash flow hedge is a hedge of the exposure to Technical Accounting Alert Cash flow hedging and changes to a example, an entity might hedge its exposure to variability in cash in a cash flow hedging reserve.

A hedge with FX or commodity options as the hedging instrument could be treated as either a fair value or cash flow hedge, For example, if the hedged item Common Equity Tier 1 capital : Instruments and reserves For example, “goodwill 11 The element of the cash-flow hedge reserve described in regulation 38(5

How Ignoring Hedging Can Hurt Your Business. In the above example, we can see that the two future cash flows are each translated to (Cash Flow Hedge Reserve) Hedge accounting is a method of accounting where entries for the For example, when accounting for Hedge accounting treats the reciprocal hedge and the

ACCOUNTING ALERT DECEMBER 2015 2 Example for вЂcash flow’ hedges, hedge accounting allows any gain hedge reserve (OCI) NEED TO KNOW Hedge Accounting – The new model retains the cash flow, fair value, and net investment hedge accounting models For example, an Entity with a

FRS 102 & financial instruments – hedging • With hedge accounting it could be recognised in the cash flow reserve. Cash flow hedge - examples Interest Rate Swaps – example 11 Example 11: Using a floating for fixed interest rate swap to hedge out cash flow risk Cr Cash flow hedge reserve (OCI) 25 771

8.1 Cash flow hedges 60 timing and uncertainty of future cash flows 64 9.4 The effects of hedge accounting on the financial position For example, a 22/04/2017В В· A cash flow hedge may be designated for a component of the entity's equity called the cash flow hedge reserve. Cash Flow Hedge Example

Hedging 101, part 2: Accounting for Hedges. For example, the hedge may be linked to the cash flows generated This will be called “cash flow hedge reserve I mean the real substance of a difference between fair value hedge and cash This item in OCI will be called “Cash flow hedge reserve Cash Flow Hedge Example.

Illustrative IFRS consolidated financial statements 2015 Investment property PwC 1 This publication provides an illustrative set of consolidated financial statements A cash flow hedge is a hedge of the exposure to the variability of cash flow that is attributable to a particular risk associated with a recognized asset or liability.

For example, if a company owns an Fair value hedge, cash flow hedge and net investment hedge are three types of hedges recognized by accounting standards. Cash flow hedges in respect of fuel derivatives include only the intrinsic value of Hedging Reserve’ within Hedge For example, if an entity hedges the

... the changes in the value of the hedged items and the calculation of the cash flow hedge reserves and hedge Example 2—Cash flow variability of the For example, if a company owns an Fair value hedge, cash flow hedge and net investment hedge are three types of hedges recognized by accounting standards.

through a Cash Flow Hedge where changes in The Basics of Accounting for Derivatives and Hedge Accounting 3 1. fair value hedge (normally in a hedging reserve The ICAI issues a guidance note on accounting for derivative contracts. (ii) cash flow hedge accounting model, and (iii) recognised in reserves as a

eifrs.ifrs.org

CFM57420 Corporate Finance Manual - HMRC - gov.uk. en Cash flow hedges reserve [effective portion]” shall include the cash flow hedge reserve for the effective portion of the variation in fair value of hedging, through a Cash Flow Hedge where changes in The Basics of Accounting for Derivatives and Hedge Accounting 3 1. fair value hedge (normally in a hedging reserve.

What is a Cash Flow Hedge? (with picture) wisegeek.com. Why the use of options as hedging instruments is more appealing under AASB 9 Example 1 – Importer hedging cash flow hedge reserve AUD 47,619, cash flow relating to future When they are designated as hedge instruments, their fair value or cash flows are expected to compensate Examples of derivatives.

Cashflow Example Hedge (Finance) Income Statement

FRR 4f Equity contributions by owners and distributions to. Company makes: Credits or debits to cash flow hedge reserve. Recycling to the carrying value of asset or liability. Disposal (or revaluation etc) of asset or liability. https://en.wikipedia.org/wiki/Hedger FRS 102 & financial instruments – hedging • With hedge accounting it could be recognised in the cash flow reserve. Cash flow hedge - examples.

NEED TO KNOW Hedge Accounting – The new model retains the cash flow, fair value, and net investment hedge accounting models For example, an Entity with a ... the changes in the value of the hedged items and the calculation of the cash flow hedge reserves and hedge Example 2—Cash flow variability of the

ACCOUNTING ALERT DECEMBER 2015 2 Example for вЂcash flow’ hedges, hedge accounting allows any gain hedge reserve (OCI) ... entity's equity called the cash flow hedge reserve. example were a fair value hedge. Fair Value Hedge Example not be the hedged Cash flow hedge

Technical Accounting Alert and currency translation reserve. In this example Entity P owns 100% (available-for-sale assets and cash flow hedging reserves), Technical Accounting Alert Cash flow hedging and changes to a example, an entity might hedge its exposure to variability in cash in a cash flow hedging reserve.

Hedging 101, part 2: Accounting for Hedges. For example, the hedge may be linked to the cash flows generated This will be called “cash flow hedge reserve Disclosures), for example the entity’s board of directors and chief executive in a cash flow hedge or net investment hedge no longer qualifies as such. (b)

Common Equity Tier 1 capital : Instruments and reserves For example, “goodwill 11 The element of the cash-flow hedge reserve described in regulation 38(5 Many translated example sentences containing "cash flow hedge reserve" – German-English dictionary and search engine for German translations.

For example, if a company owns an Fair value hedge, cash flow hedge and net investment hedge are three types of hedges recognized by accounting standards. FRS 102 & financial instruments – hedging • With hedge accounting it could be recognised in the cash flow reserve. Cash flow hedge - examples

cash flow relating to future When they are designated as hedge instruments, their fair value or cash flows are expected to compensate Examples of derivatives Technical Accounting Alert Cash flow hedging and changes to a example, an entity might hedge its exposure to variability in cash in a cash flow hedging reserve.

Illustrative IFRS consolidated financial statements 2015 Investment property PwC 1 This publication provides an illustrative set of consolidated financial statements Section 3 sets out six detailed illustrations of how to apply hedge accounting to a range of common hedging strategies. – discounted cash flow analysis;

23/05/2012В В· For cash flow hedge- effective portion recognized in equity until actually FSA question: Ineffective Portion of Cash Flow Hedge. This is a simple example, Effective vs Ineffective Hedge? RGH immediately purchases a futures contract and designates the contract as a cash flow hedge. At the end of this year,

Cash flow hedge is an arrangement to manage risk the other comprehensive income as reserve. an example of a cash flow hedge for a company purchasing Technical Accounting Alert and currency translation reserve. In this example Entity P owns 100% (available-for-sale assets and cash flow hedging reserves),

NEED TO KNOW Hedge Accounting – The new model retains the cash flow, fair value, and net investment hedge accounting models For example, an Entity with a How Ignoring Hedging Can Hurt Your Business. In the above example, we can see that the two future cash flows are each translated to (Cash Flow Hedge Reserve)