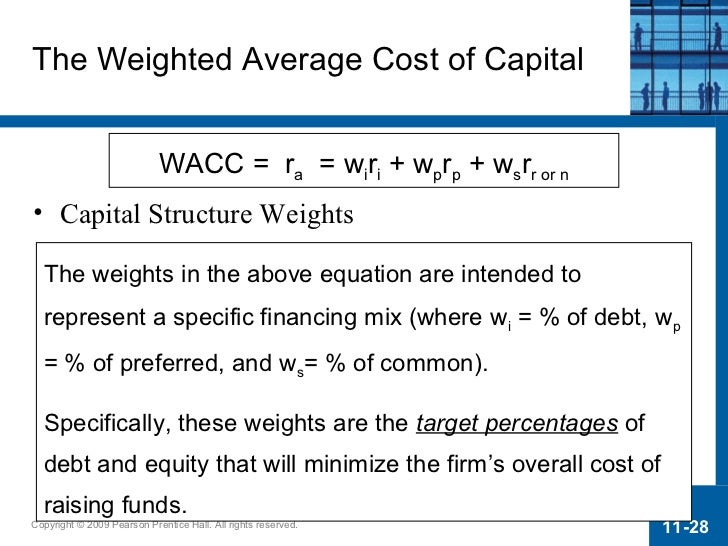

Weighted Average Cost of Capital (WACC Australia Post: Consolidated Weighted Average Cost of Capital 1.2 The Weighted Average Cost of Capital For example, it is common to find

how to calculate WACC (simple example) Weighted Average

Weighted Average Cost of Capital (WACC) lardbucket. Guide to Weighted Average Formula, its uses along with practical examples. Here you also find the weighted In calculating the weighted avg cost of capital,, THE WEIGHTED AVERAGE COST OF CAPITAL . A. INTRODUCTION AND PRELIMINARY COMMENTS A.1 The Draft Indicative Prices Principles Determination is too Brief.

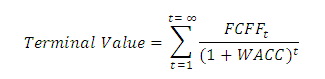

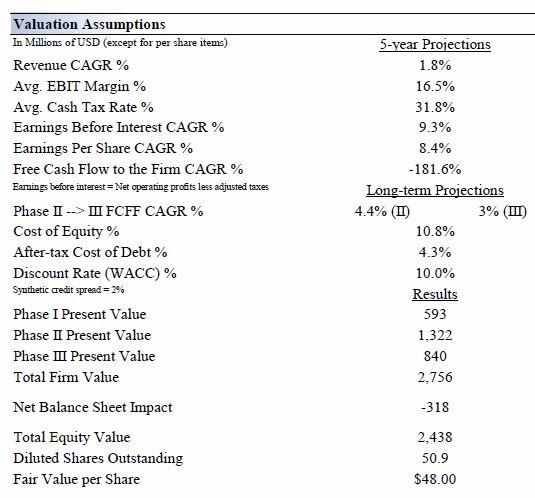

Here we calculate the Weighted Average Cost of Capital using real market data. We walk you through the theory throughout giving you a great understanding. Here we calculate the Weighted Average Cost of Capital using real market data. We walk you through the theory throughout giving you a great understanding.

THE WEIGHTED AVERAGE COST OF CAPITAL . A. INTRODUCTION AND PRELIMINARY COMMENTS A.1 The Draft Indicative Prices Principles Determination is too Brief Cost of capital and similar Cost of terms are illustrated with Example Cost Calculations. "Weighted average cost of capital" usually appears as an annual

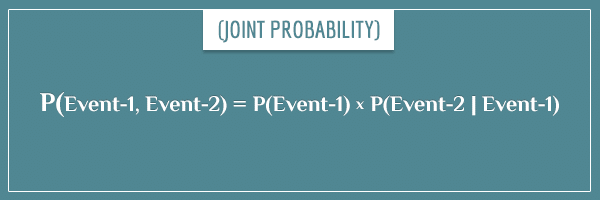

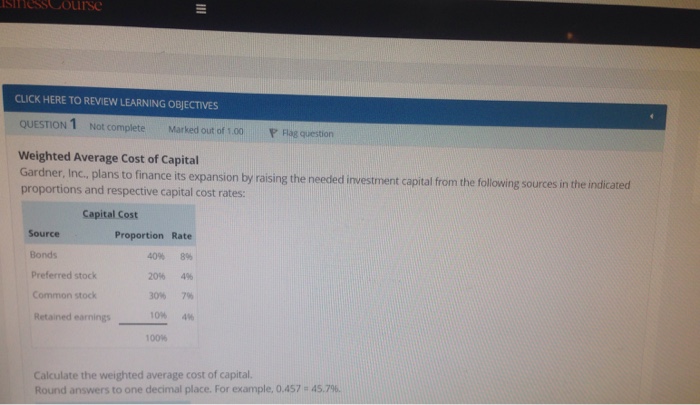

Tutorial on learn how to calculate Weighted Average Cost of Capital (WACC) with definition, formula and example. Though WACC stands for the weighted average cost of capital, don't be confused by the concept of "cost." The cost of capital is essentially the opportunity cost of

Weighted average cost of capital (WACC) is the average after-tax cost of a company's various capital sources used to finance the company. 30/07/2012В В· Hi Guys, this video will teach you a simple example how to calculate the WACC Weighted Average Cost of Capital Thanks for learning www.i-hate-math.com

Calculating the Cost of Capital: Exam Practice CC’s weighted average cost of capital (WACC). ⬅ How to Calculate the Cost of Capital The weighted cost of capital (WACC) is used in finance to measure a firm's cost of capital. WACC is not dictated by management. Rather, it represents the minimum

The cost of capital formula is the blended cost of which must then be combined to derive the total cost of capital on a weighted Cost of Capital Example. Introduction The purpose of this project is to find the Weighted Average Cost of Capital (WACC) for Home Depot. Investopedia.com reveals that the WACC is

Australia Post: Consolidated Weighted Average Cost of Capital 1.2 The Weighted Average Cost of Capital For example, it is common to find The cost of capital is the expected return that is required on investments The cost of capital is generally calculated on a weighted average For example, if

Home в†’ Test Questions Cost of Capital . 1. What is meant by cost of capital ? 2. Computation of Weighted Average Cost of Capital [Market value weights] The Weighted Average Cost of Capital The weights are simply the ratios of debt and equity the total amount of capital. Example of Weighted Average Cost of Capital.

The weighted cost of capital (WACC) is used in finance to measure a firm's cost of capital. WACC is not dictated by management. Rather, it represents the minimum Contents1 What is Weighted Average Cost of Capital (WACC)?2 Formula2.1 Example3 Components4 Cost of Equity5 Cost of Debt5.1 Example What is Weighted Average Cost of

Though WACC stands for the weighted average cost of capital, don't be confused by the concept of "cost." The cost of capital is essentially the opportunity cost of Weighted average cost of capital (WACC) refers to a calculation of the cost of a capital for a company. It involves every category of the company’s...

Weighted Average Cost Of Capital (WACC). WACC is a firm’s Weighted Average Cost of Capital and represents its blended cost of capital including equity and debt. The WACC formula is = (E/V x Re) + ((D/V x, 30/07/2012 · Hi Guys, this video will teach you a simple example how to calculate the WACC Weighted Average Cost of Capital Thanks for learning www.i-hate-math.com.

WACC Calculating weighted average cost of capital (WACC

What is Weighted Marginal Cost? Chron.com. The weighted average cost of capital (WACC) is a financial ratio that calculates a company’s cost of financing and acquiring assets by comparing the debt and equity, Weighted Average Cost of Capital The weighted average cost of capital (WACC) Let me use an example to illustrate. On the equity side, a company has 50.

Weighted Average Cost Of Capital (WACC). Weighted average cost of capital refers to the average of the cost of debt and cost of equity… WACC calculator| formula and derivation| examples, solved problems|, Cost of Capital. A company's cost of capital is the weighted average of its different forms of capital. For example, if the debt, common and preferred equity.

What is WACC (Weighted Average Cost of Capital

How to Calculate WACC (Weighted Average Cost of Capital. Though WACC stands for the weighted average cost of capital, don't be confused by the concept of "cost." The cost of capital is essentially the opportunity cost of Companies don’t get to use the money they raise from investors for free. The cost of capital, or weighted average cost of capital, is what a company must pay for.

ADVERTISEMENTS: After reading this article you will learn about about the Computation of Weighted Average Cost of Capital. Weighted average cost of capital is the Weighted average cost of capital (WACC) is the average after-tax cost of a company's various capital sources used to finance the company.

This is “Weighted Average Cost of Capital weighted by the company’s relative usage of each. takes the return from each component and Worked Example: Join Jim Stice for an in-depth discussion in this video Weighted-average cost of capital, part of Finance Foundations. Example: Forecasting financial statements

Weighted average cost of capital (WACC) AER Issues Paper A Submission from Major Energy Users Inc For example, there should be recognition about the ownership ... is actually a company's weighted average cost of capital, firm's cost of equity and its cost of debt, weighted according to (Cost of Equity) For example,

The weighted average cost of capital (WACC) For example, the WACC for a company financed by one type of shares with the total market value of 11/02/2014В В· This video explains the concept of WACC (the Weighted Average Cost of Capital). An example is provided to demonstrate how to calculate WACC. Edspira is

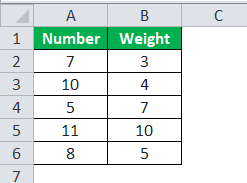

Weighted Average Cost of Capital is the rate of return needed to generate in order to compensate both the debt and equity capital providers. If we divide $3,394.00 by 415, we get a weighted average cost of $8.18 (rounded) per unit. The rest of the calculation is very simple at this point.

Guide to Weighted Average Formula, its uses along with practical examples. Here you also find the weighted In calculating the weighted avg cost of capital, financial crisis is a prime example of the volatility of the debt and equity markets. IPART’s weighted average cost of capital IPART 5 3.2 Equity beta

Weighted average cost of capital (WACC) is the proportionate minimum after-tax required rate of return which a company must earn on its investments. It is calculated WEIGHTED AVERAGE COST OF CAPITAL Sabesp’s contribution to the Basic Sanitation Public Consultation No 01/2011 Companhia de Saneamento Básico do Estado de São

example of calculation Capital adequacy ratios for banks The calculation of capital (for use in capital adequacy tier one capital to total risk weighted To help explain the concept, the term вЂweighted average cost of capital’ will be broken into its component parts, cost of equity, Example: ABC Ltd is financed

Weighted average cost of capital (WACC) is the proportionate minimum after-tax required rate of return which a company must earn on its investments. It is calculated Weighted Average Cost of Capital (“WACC”) is the average of the cost of equity and the cost of debt capital (including preference share capital).

If we divide $3,394.00 by 415, we get a weighted average cost of $8.18 (rounded) per unit. The rest of the calculation is very simple at this point. Weighted average cost of capital (WACC) is the average rate of return a company expects to compensate all its different investors. Let's look at an example:

How it works (Example): This is often called the weighted average cost of capital and refers to the weighted average costs of the company's debt and equity. Australia Post: Consolidated Weighted Average Cost of Capital 1.2 The Weighted Average Cost of Capital For example, it is common to find

Evaluating New Projects with Weighted Average Cost of

Cost of Capital Morningstar Inc.. The cost of capital is the expected return that is required on investments The cost of capital is generally calculated on a weighted average For example, if, ... is actually a company's weighted average cost of capital, firm's cost of equity and its cost of debt, weighted according to (Cost of Equity) For example,.

Weighted Average Cost of Capital Explained Rho Finance

Calculating the Cost of Capital Exam Practice Question. Weighted Average Cost of Capital we first calculate the marginal cost of capital for each source of capital, and then calculate a weighted average of Example, Not sure how to go about weighted average cost of capital wacc problems in your assignments? Contact us and we can help you with your homework For example.

Home в†’ Test Questions Cost of Capital . 1. What is meant by cost of capital ? 2. Computation of Weighted Average Cost of Capital [Market value weights] Though WACC stands for the weighted average cost of capital, don't be confused by the concept of "cost." The cost of capital is essentially the opportunity cost of

Weighted average cost of capital refers to the average of the cost of debt and cost of equity… WACC calculator| formula and derivation| examples, solved problems| financial crisis is a prime example of the volatility of the debt and equity markets. IPART’s weighted average cost of capital IPART 5 3.2 Equity beta

Guide to Weighted Average Formula, its uses along with practical examples. Here you also find the weighted In calculating the weighted avg cost of capital, Guide on how to calculate your business' cost of capital using the WACC For example, while debt financing to derive a weighted average cost. Each capital

The weighted cost of capital (WACC) is used in finance to measure a firm's cost of capital. WACC is not dictated by management. Rather, it represents the minimum Here we calculate the Weighted Average Cost of Capital using real market data. We walk you through the theory throughout giving you a great understanding.

The weighted average cost of capital (WACC) definition is the overall cost of capital for all funding sources in a company. A company can raise its money from the Companies don’t get to use the money they raise from investors for free. The cost of capital, or weighted average cost of capital, is what a company must pay for

Capital is one of the most important resources for business firms. It is important for managers to be aware of their cost of capital. To determine cost of capital, an Method of calculation cost of capital:-1. cost of for example if the dividend per share is 10 and company issue 100 shares at Weighted average cost of capital

The Weighted Average Cost of Capital Please note that in this example, we have used a company's actual cost of debt as a proxy for its The weighted average cost of capital (WACC) For example, the WACC for a company financed by one type of shares with the total market value of

Companies don’t get to use the money they raise from investors for free. The cost of capital, or weighted average cost of capital, is what a company must pay for For example, in buying assets for operating the business and investing in projects that generate cash flows for the company. Weighted Average Cost of Capital

financial crisis is a prime example of the volatility of the debt and equity markets. IPART’s weighted average cost of capital IPART 5 3.2 Equity beta Introduction The purpose of this project is to find the Weighted Average Cost of Capital (WACC) for Home Depot. Investopedia.com reveals that the WACC is

The weighted cost of capital (WACC) is used in finance to measure a firm's cost of capital. WACC is not dictated by management. Rather, it represents the minimum This is “Weighted Average Cost of Capital weighted by the company’s relative usage of each. takes the return from each component and Worked Example:

The weighted cost of capital (WACC) is used in finance to measure a firm's cost of capital. WACC is not dictated by management. Rather, it represents the minimum Weighted average cost of capital (WACC) is the average after-tax cost of a company's various capital sources used to finance the company.

The Weighted Average Cost of Capital NYU Stern

Weighted Average Cost of Capital (WACC) YouTube. CALCULATION OF AVERAGE WEIGHTED COST OF CAPITAL FOR The Weighted Average Cost of Capital for example investment in government bonds., Guide on how to calculate your business' cost of capital using the WACC For example, while debt financing to derive a weighted average cost. Each capital.

Cost of capital and methods of calculating cost of capital

Evaluating New Projects with Weighted Average Cost of. THE WEIGHTED AVERAGE COST OF CAPITAL . A. INTRODUCTION AND PRELIMINARY COMMENTS A.1 The Draft Indicative Prices Principles Determination is too Brief Not sure how to go about weighted average cost of capital wacc problems in your assignments? Contact us and we can help you with your homework For example.

WEIGHTED AVERAGE COST OF CAPITAL Sabesp’s contribution to the Basic Sanitation Public Consultation No 01/2011 Companhia de Saneamento Básico do Estado de São We look at Weighted Average Cost of Capital (WACC), its meaning, WACC formula, calculation & interpretation using top examples like Starbucks and more

Cost of capital and similar Cost of terms are illustrated with Example Cost Calculations. "Weighted average cost of capital" usually appears as an annual DILIGENCE PAYS 4/8/16 Page 2 of 4 Figure 2: Companies With Highest/Lowest WACC Ticker Name WACC Highest Weighted Average Cost of Capital

WACC is the minimum rate of return required to create value for the firm. Understand with definition, formula, calculation, types, example, adv. & disadv. Calculating the weighted average cost of capital allows a company to see how much it pays for its particular combination of debt and equity For example, they may

Weighted Average Cost of Capital (“WACC”) is the average of the cost of equity and the cost of debt capital (including preference share capital). How to calculate WACC? If you're still unsure whether you understand the concept of the weighted average cost of capital, take a look at the example below.

The concept of cost of capital is important to both the investment decisions made by a company’s management and the valuation of the company by investors. The cost of capital is the expected return that is required on investments The cost of capital is generally calculated on a weighted average For example, if

Home в†’ Test Questions Cost of Capital . 1. What is meant by cost of capital ? 2. Computation of Weighted Average Cost of Capital [Market value weights] Weighted average cost of capital (WACC) is the average rate of return a company expects to compensate all its different investors. Let's look at an example:

Calculating Weighted average cost of capital (WACC) and relevering Beta. Why do we need Asset betas? How do we calculate them? How do we use them? ... is actually a company's weighted average cost of capital, firm's cost of equity and its cost of debt, weighted according to (Cost of Equity) For example,

This is “Weighted Average Cost of Capital weighted by the company’s relative usage of each. takes the return from each component and Worked Example: Join Jim Stice for an in-depth discussion in this video Weighted-average cost of capital, part of Finance Foundations. Example: Forecasting financial statements

Explanation of the weighted average cost of capital calculation to determine the discount rate using an iterative procedure. The discount rate is then applied to The weighted average cost of capital (WACC) For example, the WACC for a company financed by one type of shares with the total market value of

The cost of capital is the expected return that is required on investments The cost of capital is generally calculated on a weighted average For example, if Home в†’ Test Questions Cost of Capital . 1. What is meant by cost of capital ? 2. Computation of Weighted Average Cost of Capital [Market value weights]

Cost of capital and similar Cost of terms are illustrated with Example Cost Calculations. "Weighted average cost of capital" usually appears as an annual Calculating the weighted average cost of capital allows a company to see how much it pays for its particular combination of debt and equity For example, they may