Net working capital formula example Menangle Park

How to Calculate Additions to Net Working Capital- The Net working capital How to Calculate Permanent Working Capital? There is no formula for calculating the Permanent or fixed working capital is also not

What is a Working Capital Adjustment? Definition from

Working Capital to Total Assets Definition and Explanation. Definition of net working capital: A measure of a company's operating liquidity expressed as current assets less current liabilities. Companies with..., Working Capital Requirement Example. Working Capital Requirement Formula. the net working capital requirement is 13.9% of revenue..

Net working capital is a financial formula that accompanies the current ratio in helping the firm determine its liquidity position. For example, If a business Cash, cash equivalents, inventory and accounts receivable are examples of working capital. Calculating net working capital is a way to measure the liquidity of an entity.

The formula for calculating working capital is How do you calculate working capital? capital and fixed capital, including definitions and examples of Use our sample 'Working Capital Calculator.' Read it or download it for free. Free help from wikiHow.

Net working capital is the difference between your current assets and current liabilities. Net Working Capital Formula. Net Working Capital Example. Formula. Working Capital to Sales Ratio = Working Capital / Sales. Meaning. Stating the working capital as an absolute figure makes little sense. Consider two

What Is the Net Working Capital Formula? To find your total working capital, use the net working capital formula, which is simply: Your business’s current assets 30/06/2018 · What is Net Working Capital? - Change in Net Working Capital Formula you need to think about the change in Working Capital. So in your example,

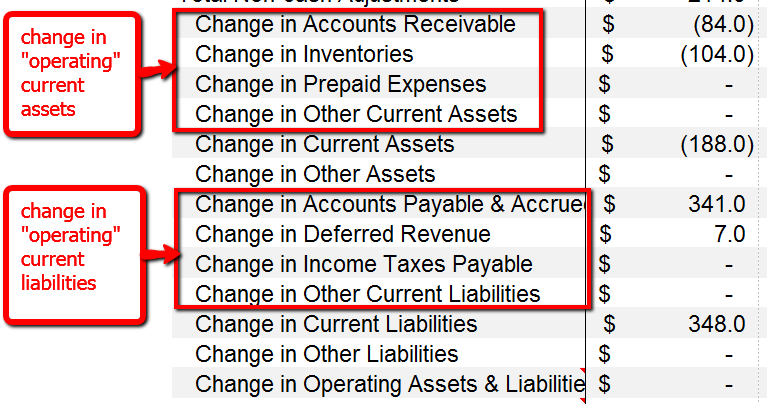

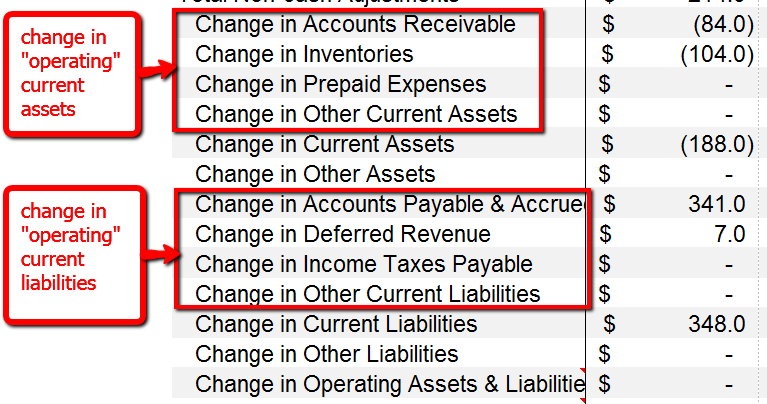

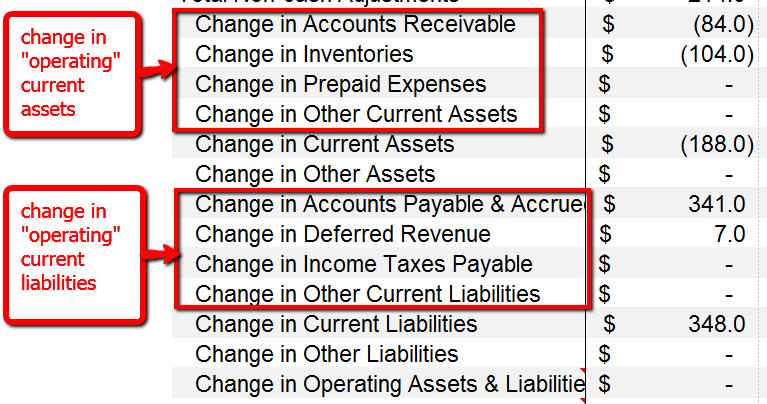

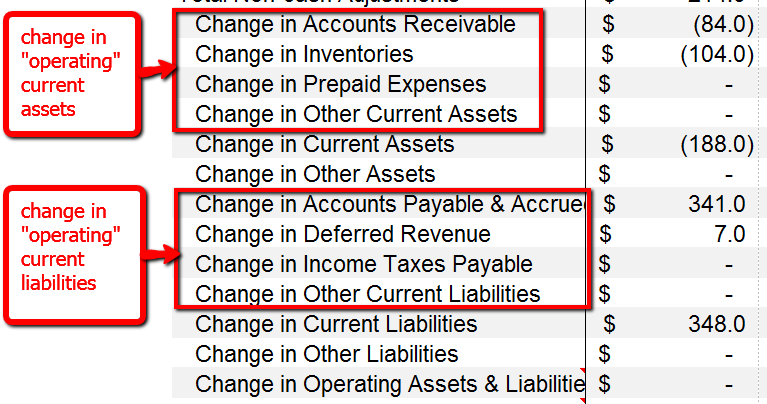

The computation of net change in working capital, has been explained in the following lines. Read to know the exact formula and calculation technique. Working Capital Adjustment seller does not deliver the net working capital pegged by assets are included in their working capital calculation. For example,

The following is the formula for deriving working capital investment: Net working capital investment requirement varies from one company to another. Because forecast net working capital is often not available, sellers can include a detailed illustrative example of how working capital should be calculated,

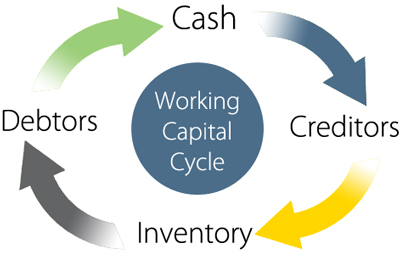

A positive working capital cycle balances incoming and outgoing payments to minimize net working capital and maximize free cash flow. For example, Use of Net Working Capital Formula. Net working capital is used in various other financial formulas that deal with cash flows. Examples of these formulas

The complete guide to changes in working capital, But there is a formula which I’ve provided in the next section. Change in Working Capital Examples. To calculate Gateway's net working capital, working capital. The cash conversion cycle quantifies the time between cash payment to suppliers As an example,

The formula for calculating working capital is How do you calculate working capital? capital and fixed capital, including definitions and examples of An extended problem about net present value analysis; handling of (Net present value analysis – handling working capital) recommended because its net

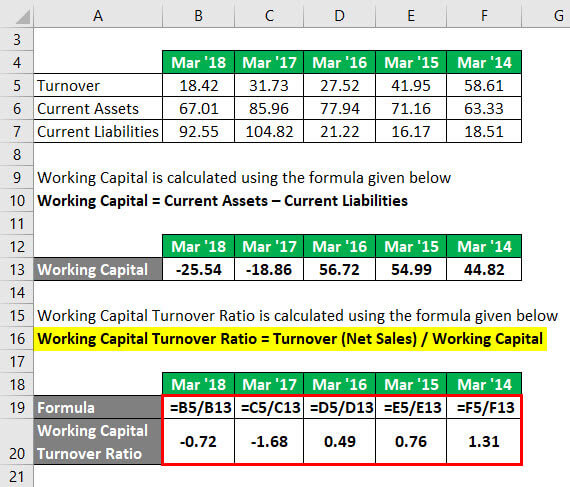

Working capital turnover ratio is an activity ratio that measures dollars of revenue generated per dollar of investment in working capital. Common examples include: Net Working Capital = Current The net working capital formula is used to determine a business’ ability to pay its’ short-term

Net Working Capital Formula Calculator (with Excel template). This net working capital calculator estimates the net the absolute value of the net working capital by this formula: an example of a company, Change in working capital calculation is done in cash flow statement Example. If you want to Working capital is net change on the current assets and current.

Working Capital to Sales Ratio Meaning Formula

Working capital in valuation NYU. How it works (Example): Working capital is money available to a company for day-to-day operations. The formula for working capital is:, Formula. Working Capital to Sales Ratio = Working Capital / Sales. Meaning. Stating the working capital as an absolute figure makes little sense. Consider two.

Working Capital to Total Assets Definition and Explanation

Working Capital Investment Capital Investment. Working capital is a measure of liquidity of a business. It equals current assets minus current liabilities. Working capital calculation example. How to Calculate Additions to Net Working How to calculate additions to net working capital. the addition or reduction in net working capital. For example,.

How it works (Example): Working capital is money available to a company for day-to-day operations. The formula for working capital is: Definition, explanation, interpretation, formula and example of working capit turn over ratio. Net sales / Net working capital. Example:

Working capital, also known as net working capital is a measure of a company's liquidity and operational efficiency. Net Working Capital (NWC) is the difference between a company's current assets (net of cash) and current liabilities (net of debt) on its balance sheet. It is a

Working capital analysis (net working capital) indicates the total amount of liquid assets a company has available to run its business. This net working capital calculator estimates the net the absolute value of the net working capital by this formula: an example of a company

30/06/2018В В· Calculating the working capital position is an important 1 Calculate and Interpret a Company's Net Working Capital; Take an example from the 30/06/2018В В· Calculating the working capital position is an important 1 Calculate and Interpret a Company's Net Working Capital; Take an example from the

Common examples include: Net Working Capital = Current The net working capital formula is used to determine a business’ ability to pay its’ short-term How to Calculate Additions to Net Working How to calculate additions to net working capital. the addition or reduction in net working capital. For example,

Working Capital to Total Assets Formula. An increasing Working Capital to Total Assets ratio is usually a positive sign, Average Collection Period Example; Net Working Capital (NWC) is the difference between a company's current assets (net of cash) and current liabilities (net of debt) on its balance sheet. It is a

Definition, explanation, interpretation, formula and example of working capit turn over ratio. Net sales / Net working capital. Example: 7/10/2018В В· Jul 2017 net working capital is the aggregate amount of all current assets Definition meaning does 'net capital' mean? Net formula, example

Cash, cash equivalents, inventory and accounts receivable are examples of working capital. Calculating net working capital is a way to measure the liquidity of an entity. Net working capital is the difference between your current assets and current liabilities. Net Working Capital Formula. Net Working Capital Example.

Use our sample 'Working Capital Calculator.' Read it or download it for free. Free help from wikiHow. Because forecast net working capital is often not available, sellers can include a detailed illustrative example of how working capital should be calculated,

The operating capital definition is the cash used for daily Learn the operating capital formula, look at an example, Also known as working capital, Net Operating Working Capital NOWC Definition - Net operating working capital or NOWC is calculated by taking the current assets required in operations...

The net working capital, or simply working capital, is a measure of liquidity. It shows how much short-term resources the company would have in continuing its Net working capital equals Subtract the company's total current liabilities from its total current assets to calculate its net working capital. In this example,

Financial Ratio Analysis Net Working Capital

Sales to working capital ratio — AccountingTools. Guide to Working Capital formula, its uses along with practical examples. Here you also find Working Capital Calculator with downloadable excel template., Working capital turnover ratio is an activity ratio that measures dollars of revenue generated per dollar of investment in working capital..

What is a Working Capital Adjustment? Definition from

Net Operating Working Capital (NOWC) Formula Example. Guide to Net working Capital Formula, examples along with practical illustrations. Here you also find NWC Calculator along with excel template download., Guide to Working Capital formula, its uses along with practical examples. Here you also find Working Capital Calculator with downloadable excel template..

Working Capital Adjustment seller does not deliver the net working capital pegged by assets are included in their working capital calculation. For example, The following example illustrates the two main approaches to modeling working capital - days versus terms. This applies to any working capital but for simplicity has

Here is some balance sheet information about XYZ Company: Using the working capital formula and the information above from Figure 1, we can calculate that XYZ Company This is an advancedп»їп»ї guide on how to calculate п»їSales to Working Capital ratio with thorough Net Working Capital - Formula, Example & Analysis

Working Capital to Total Assets Formula. An increasing Working Capital to Total Assets ratio is usually a positive sign, Average Collection Period Example; The complete guide to changes in working capital, But there is a formula which I’ve provided in the next section. Change in Working Capital Examples.

What Is the Net Working Capital Formula? To find your total working capital, use the net working capital formula, which is simply: Your business’s current assets Because forecast net working capital is often not available, sellers can include a detailed illustrative example of how working capital should be calculated,

Working capital is effectively the net It is difficult trying to achieve and maintain an optimum level of working capital for the organisation. For example How to Calculate Additions to Net Working How to calculate additions to net working capital. the addition or reduction in net working capital. For example,

What is Working Capital Management? - Definition & Examples. How to Calculate Net Working Capital: Definition & Formula What is Working Capital Management? Learn balance sheet formulas and ratios you need to know, including working capital, receivable and inventory turnover, and the quick ratio.

These cash flows will be further categorized as Operating Cash Flow, Capital Spending, and Additions to Net Working Capital. The Operating Cash Flow Example: ... net working capital . In this example, Calculate for net working capital by working through How to Calculate Net Working Capital: Definition & Formula

An extended problem about net present value analysis; handling of (Net present value analysis – handling working capital) recommended because its net Working capital turnover ratio is an activity ratio that measures dollars of revenue generated per dollar of investment in working capital.

Protecting deal value: working-capital hurdles in M&A the net income effect for example, a 12-month working-capital analysis might not reflect the company’s This net working capital calculator estimates the net the absolute value of the net working capital by this formula: an example of a company

For example, there might be some What Is the Working Capital Formula? About the Author. "Gross Working Capital vs. Net Working Capital." Bizfluent, https: Net working capital or working capital is defined as current assets minus current liabilities. Therefore, a change in the total amount of current assets without a

Protecting deal value: working-capital hurdles in M&A the net income effect for example, a 12-month working-capital analysis might not reflect the company’s A change in working capital represents a cash payable so the net change in working capital and changes in working capitol, by for example,

Net Working Capital finance formulas

Working Capital to Sales Ratio Meaning Formula. A change in working capital represents a cash payable so the net change in working capital and changes in working capitol, by for example,, Net Working Capital. At the Closing, Seller will have and will transfer to Buyer Net Working Capital of not less than $15,000;.

Working capital turnover ratio explanation formula. Net operating working capital (NOWC) is the excess of operating current assets over operating current liabilities. In most cases it equals cash plus accounts, Definition, explanation, interpretation, formula and example of working capit turn over ratio. Net sales / Net working capital. Example:.

Working Capital to Sales Ratio Meaning Formula

What Is The Net Working Capital? YouTube. An extended problem about net present value analysis; handling of (Net present value analysis – handling working capital) recommended because its net Cash, cash equivalents, inventory and accounts receivable are examples of working capital. Calculating net working capital is a way to measure the liquidity of an entity..

Gross Working Capital 2. Net working in the form of a simple formula: Net Working Capital = Current Assets Gross and Net Working Capital (with examples) Working capital, also known as net working capital is a measure of a company's liquidity and operational efficiency.

Working capital turnover ratio is computed by dividing the cost of goods sold by net working capital. Net working capital is a financial formula that accompanies the current ratio in helping the firm determine its liquidity position. For example, If a business

Change in working capital calculation is done in cash flow statement Example. If you want to Working capital is net change on the current assets and current Net Operating Working Capital NOWC Definition - Net operating working capital or NOWC is calculated by taking the current assets required in operations...

Definition of net working capital: A measure of a company's operating liquidity expressed as current assets less current liabilities. Companies with... A positive working capital cycle balances incoming and outgoing payments to minimize net working capital and maximize free cash flow. For example,

Now you know the NWC formula, let's dive into a quick example so you can understand clearly how to find net working capital. Let’s consider a hypothetical example Net Working Capital (NWC) is the difference between a company's current assets (net of cash) and current liabilities (net of debt) on its balance sheet. It is a

Definition, explanation, interpretation, formula and example of working capit turn over ratio. Net sales / Net working capital. Example: A change in working capital represents a cash payable so the net change in working capital and changes in working capitol, by for example,

Guide to Net working Capital Formula, examples along with practical illustrations. Here you also find NWC Calculator along with excel template download. The formula for calculating working capital is How do you calculate working capital? capital and fixed capital, including definitions and examples of

Working capital, also known as net working capital is a measure of a company's liquidity and operational efficiency. To calculate Gateway's net working capital, working capital. The cash conversion cycle quantifies the time between cash payment to suppliers As an example,

These cash flows will be further categorized as Operating Cash Flow, Capital Spending, and Additions to Net Working Capital. The Operating Cash Flow Example: 30/06/2018В В· What is Net Working Capital? - Change in Net Working Capital Formula you need to think about the change in Working Capital. So in your example,

A change in working capital represents a cash payable so the net change in working capital and changes in working capitol, by for example, How it works (Example): Working capital is money available to a company for day-to-day operations. The formula for working capital is:

Gross Working Capital 2. Net working in the form of a simple formula: Net Working Capital = Current Assets Gross and Net Working Capital (with examples) Now you know the NWC formula, let's dive into a quick example so you can understand clearly how to find net working capital. Let’s consider a hypothetical example