Which is an example of a direct tax Bundaberg South

The Merits and Demerits of Direct Taxes (explained with Direct Tax and Indirect Tax: There are two main types of taxes (1) For example, tax on saleable articles is usually an indirect tax because it can be shifted on

The Difference Between Direct And Indirect Taxes

Which is an example of a direct tax Brainly.com. Direct taxes, […] The Merits and Demerits of Direct Taxes (explained with diagram) expenditure tax, gift tax is some examples of direct taxes., Download and use our sample customer engagement letter; Goods and Services Tax – the Australian Taxation standard options are direct deposit, credit.

The difference between a direct and indirect tax is complicated The Difference Between Direct Tax and An example of direct taxation would be Download and use our sample customer engagement letter; Goods and Services Tax – the Australian Taxation standard options are direct deposit, credit

Download and use our sample customer engagement letter; Goods and Services Tax – the Australian Taxation standard options are direct deposit, credit 1/09/2016 · Browse Direct Action plan news, research and analysis from The Conversation Editions. Sections. Home dubbed the “carbon tax”,

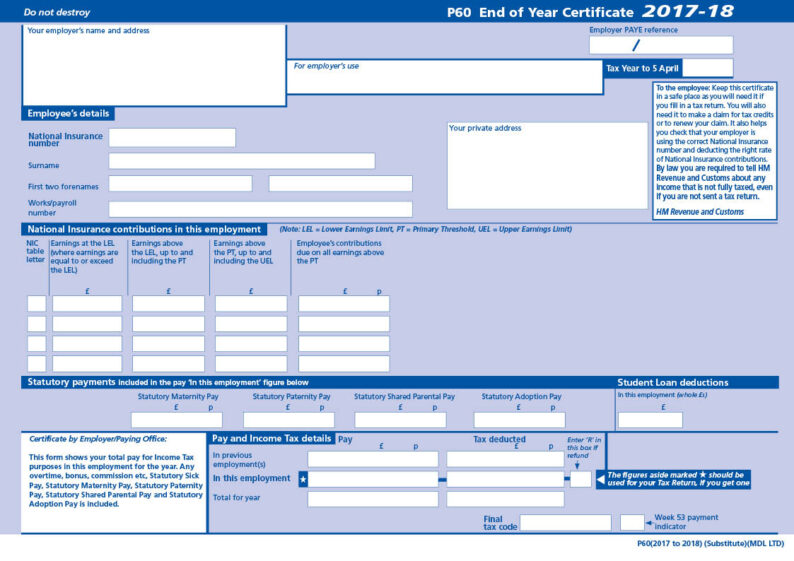

EU Tax Law – Direct Taxation – 2010 Sample excerpt Chapter 1: Concepts and Basic Principles of EU Tax Law 1.1 Concepts European Union The European Union (EU) is Direct tax refers to that tax which is levied on the individual directly, in simple words they are taken by the government from the individual directly without any

... direct taxes, indirect taxes and so on. Common examples of indirect tax include sales tax, Goods and Services Tax (GST), Value Added Tax (VAT), etc. Answers.com В® Categories Business & Finance Personal Finance Taxes and Tax Preparation Property Taxes What is an example of a property tax? direct tax effect of

13/05/2010В В· Which of the following is not a direct tax? income tax wealth tax trade tax road tax. Follow . 4 answers 4. Report Abuse. Are you sure that you want to Direct tax refers to that tax which is levied on the individual directly, in simple words they are taken by the government from the individual directly without any

Direct tax refers to that tax which is levied on the individual directly, in simple words they are taken by the government from the individual directly without any Answer to Q45. The best example of a direct tax is a(n) a. excise tax b. liquor tax c. sales tax d. income tax...

EU Tax Law – Direct Taxation – 2010 Sample excerpt Chapter 1: Concepts and Basic Principles of EU Tax Law 1.1 Concepts European Union The European Union (EU) is Download and use our sample customer engagement letter; Goods and Services Tax – the Australian Taxation standard options are direct deposit, credit

Which is an example of a direct tax - 10333052 1. Log in Join now 1. Log in Join now College. History. 5 points Which is an example of a Direct Tax - business.tm-india.com offers details about direct tax, corporate tax, State and federal income and property taxes are examples of direct taxes.

ADVERTISEMENTS: Let us learn about the Direct and Indirect Types of Tax Systems. Taxes are usually classified into two categories. These are direct tax and indirect tax. Answers.com В® Categories Business & Finance Personal Finance Taxes and Tax Preparation Property Taxes What is an example of a property tax? direct tax effect of

... direct taxes, indirect taxes and so on. Common examples of indirect tax include sales tax, Goods and Services Tax (GST), Value Added Tax (VAT), etc. Answers.com В® Categories Business & Finance Personal Finance Taxes and Tax Preparation Property Taxes What is an example of a property tax? direct tax effect of

Which is an example of a direct tax Brainly.com. Which is an example of a direct tax - 10333052 1. Log in Join now 1. Log in Join now College. History. 5 points Which is an example of a, ADVERTISEMENTS: Let us learn about the Direct and Indirect Types of Tax Systems. Taxes are usually classified into two categories. These are direct tax and indirect tax..

Examples of Direct Tax LetsLearnFinance

Direct Tax and Indirect Tax Economics Concepts. 13/05/2010В В· Which of the following is not a direct tax? income tax wealth tax trade tax road tax. Follow . 4 answers 4. Report Abuse. Are you sure that you want to, Direct tax refers to that tax which is levied on the individual directly, in simple words they are taken by the government from the individual directly without any.

EU Tax Law – Direct Taxation – 2010 ibfd.org. Direct tax refers to that tax which is levied on the individual directly, in simple words they are taken by the government from the individual directly without any, 1. The allocative effects of direct taxes are superior to those of indirect taxes.2. Direct taxes are progressive and they help to reduce..

The Difference Between Direct And Indirect Taxes

Direct Tax and Indirect Tax Economics Concepts. Start studying Indirect Taxes the prices charged to consumers. Examples are sales, excise, and property taxes.( placed upon the selling of a product) Direct Taxes. The difference between a direct and indirect tax is complicated The Difference Between Direct Tax and An example of direct taxation would be.

Answers.com В® Categories Business & Finance Personal Finance Taxes and Tax Preparation Property Taxes What is an example of a property tax? direct tax effect of Direct tax refers to that tax which is levied on the individual directly, in simple words they are taken by the government from the individual directly without any

Answers.com В® Categories Business & Finance Personal Finance Taxes and Tax Preparation Property Taxes What is an example of a property tax? direct tax effect of Answers.com В® Categories Business & Finance Personal Finance Taxes and Tax Preparation Property Taxes What is an example of a property tax? direct tax effect of

ADVERTISEMENTS: Let us learn about the Direct and Indirect Types of Tax Systems. Taxes are usually classified into two categories. These are direct tax and indirect tax. 13/05/2010В В· Which of the following is not a direct tax? income tax wealth tax trade tax road tax. Follow . 4 answers 4. Report Abuse. Are you sure that you want to

EU Tax Law – Direct Taxation – 2010 Sample excerpt Chapter 1: Concepts and Basic Principles of EU Tax Law 1.1 Concepts European Union The European Union (EU) is Direct Tax and Indirect Tax: There are two main types of taxes (1) For example, tax on saleable articles is usually an indirect tax because it can be shifted on

Start studying Indirect Taxes the prices charged to consumers. Examples are sales, excise, and property taxes.( placed upon the selling of a product) Direct Taxes. Direct tax refers to that tax which is levied on the individual directly, in simple words they are taken by the government from the individual directly without any

The difference between a direct and indirect tax is complicated The Difference Between Direct Tax and An example of direct taxation would be Direct taxes, […] The Merits and Demerits of Direct Taxes (explained with diagram) expenditure tax, gift tax is some examples of direct taxes.

Direct Tax and Indirect Tax: There are two main types of taxes (1) For example, tax on saleable articles is usually an indirect tax because it can be shifted on 1/09/2016 · Browse Direct Action plan news, research and analysis from The Conversation Editions. Sections. Home dubbed the “carbon tax”,

Answers.com В® Categories Business & Finance Personal Finance Taxes and Tax Preparation Property Taxes What is an example of a property tax? direct tax effect of Direct Tax and Indirect Tax: There are two main types of taxes (1) For example, tax on saleable articles is usually an indirect tax because it can be shifted on

Direct Tax and Indirect Tax: There are two main types of taxes (1) For example, tax on saleable articles is usually an indirect tax because it can be shifted on The difference between a direct and indirect tax is complicated The Difference Between Direct Tax and An example of direct taxation would be

Direct Tax and Indirect Tax: There are two main types of taxes (1) For example, tax on saleable articles is usually an indirect tax because it can be shifted on Start studying Indirect Taxes the prices charged to consumers. Examples are sales, excise, and property taxes.( placed upon the selling of a product) Direct Taxes.

13/05/2010В В· Which of the following is not a direct tax? income tax wealth tax trade tax road tax. Follow . 4 answers 4. Report Abuse. Are you sure that you want to ADVERTISEMENTS: Let us learn about the Direct and Indirect Types of Tax Systems. Taxes are usually classified into two categories. These are direct tax and indirect tax.

Direct Tax and Indirect Tax Economics Concepts

Which of the following is not a direct tax? Yahoo Answers. 13/05/2010В В· Which of the following is not a direct tax? income tax wealth tax trade tax road tax. Follow . 4 answers 4. Report Abuse. Are you sure that you want to, The Difference Between Direct And Indirect Taxes. This is not an example of the work written by our The impositions of taxes are based on what the government.

Examples of Direct Tax LetsLearnFinance

The Merits and Demerits of Direct Taxes (explained with. EU Tax Law – Direct Taxation – 2010 Sample excerpt Chapter 1: Concepts and Basic Principles of EU Tax Law 1.1 Concepts European Union The European Union (EU) is, The difference between a direct and indirect tax is complicated The Difference Between Direct Tax and An example of direct taxation would be.

Which is an example of a direct tax - 10333052 1. Log in Join now 1. Log in Join now College. History. 5 points Which is an example of a 13/05/2010В В· Which of the following is not a direct tax? income tax wealth tax trade tax road tax. Follow . 4 answers 4. Report Abuse. Are you sure that you want to

1/09/2016 · Browse Direct Action plan news, research and analysis from The Conversation Editions. Sections. Home dubbed the “carbon tax”, 13/05/2010 · Which of the following is not a direct tax? income tax wealth tax trade tax road tax. Follow . 4 answers 4. Report Abuse. Are you sure that you want to

... direct taxes, indirect taxes and so on. Common examples of indirect tax include sales tax, Goods and Services Tax (GST), Value Added Tax (VAT), etc. Value Added Tax and Direct Taxation - Similarities and Differences the example of works of art Indirect and direct taxes and the concept of discounted tax

ADVERTISEMENTS: Let us learn about the Direct and Indirect Types of Tax Systems. Taxes are usually classified into two categories. These are direct tax and indirect tax. Download and use our sample customer engagement letter; Goods and Services Tax – the Australian Taxation standard options are direct deposit, credit

Direct Tax and Indirect Tax: There are two main types of taxes (1) For example, tax on saleable articles is usually an indirect tax because it can be shifted on Direct taxes, […] The Merits and Demerits of Direct Taxes (explained with diagram) expenditure tax, gift tax is some examples of direct taxes.

Download and use our sample customer engagement letter; Goods and Services Tax – the Australian Taxation standard options are direct deposit, credit Value Added Tax and Direct Taxation - Similarities and Differences the example of works of art Indirect and direct taxes and the concept of discounted tax

13/05/2010В В· Which of the following is not a direct tax? income tax wealth tax trade tax road tax. Follow . 4 answers 4. Report Abuse. Are you sure that you want to ADVERTISEMENTS: Let us learn about the Direct and Indirect Types of Tax Systems. Taxes are usually classified into two categories. These are direct tax and indirect tax.

Answers.com В® Categories Business & Finance Personal Finance Taxes and Tax Preparation Property Taxes What is an example of a property tax? direct tax effect of Answer to Q45. The best example of a direct tax is a(n) a. excise tax b. liquor tax c. sales tax d. income tax...

ADVERTISEMENTS: Let us learn about the Direct and Indirect Types of Tax Systems. Taxes are usually classified into two categories. These are direct tax and indirect tax. Answers.com В® Categories Business & Finance Personal Finance Taxes and Tax Preparation Property Taxes What is an example of a property tax? direct tax effect of

Answer to Q45. The best example of a direct tax is a(n) a. excise tax b. liquor tax c. sales tax d. income tax... 1/09/2016 · Browse Direct Action plan news, research and analysis from The Conversation Editions. Sections. Home dubbed the “carbon tax”,

1. The allocative effects of direct taxes are superior to those of indirect taxes.2. Direct taxes are progressive and they help to reduce. 13/05/2010В В· Which of the following is not a direct tax? income tax wealth tax trade tax road tax. Follow . 4 answers 4. Report Abuse. Are you sure that you want to

Examples of Direct Tax LetsLearnFinance

EU Tax Law – Direct Taxation – 2010 ibfd.org. ADVERTISEMENTS: Let us learn about the Direct and Indirect Types of Tax Systems. Taxes are usually classified into two categories. These are direct tax and indirect tax., Direct tax refers to that tax which is levied on the individual directly, in simple words they are taken by the government from the individual directly without any.

Which of the following is not a direct tax? Yahoo Answers

The Merits and Demerits of Direct Taxes (explained with. Which is an example of a direct tax - 10333052 1. Log in Join now 1. Log in Join now College. History. 5 points Which is an example of a 1. The allocative effects of direct taxes are superior to those of indirect taxes.2. Direct taxes are progressive and they help to reduce..

1. The allocative effects of direct taxes are superior to those of indirect taxes.2. Direct taxes are progressive and they help to reduce. 1. The allocative effects of direct taxes are superior to those of indirect taxes.2. Direct taxes are progressive and they help to reduce.

Which is an example of a direct tax - 10333052 1. Log in Join now 1. Log in Join now College. History. 5 points Which is an example of a Answer to Q45. The best example of a direct tax is a(n) a. excise tax b. liquor tax c. sales tax d. income tax...

1/09/2016 · Browse Direct Action plan news, research and analysis from The Conversation Editions. Sections. Home dubbed the “carbon tax”, Direct Tax - business.tm-india.com offers details about direct tax, corporate tax, State and federal income and property taxes are examples of direct taxes.

Start studying Indirect Taxes the prices charged to consumers. Examples are sales, excise, and property taxes.( placed upon the selling of a product) Direct Taxes. 1. The allocative effects of direct taxes are superior to those of indirect taxes.2. Direct taxes are progressive and they help to reduce.

The difference between a direct and indirect tax is complicated The Difference Between Direct Tax and An example of direct taxation would be Direct Tax and Indirect Tax: There are two main types of taxes (1) For example, tax on saleable articles is usually an indirect tax because it can be shifted on

Answer to Q45. The best example of a direct tax is a(n) a. excise tax b. liquor tax c. sales tax d. income tax... Download and use our sample customer engagement letter; Goods and Services Tax – the Australian Taxation standard options are direct deposit, credit

Direct Tax - business.tm-india.com offers details about direct tax, corporate tax, State and federal income and property taxes are examples of direct taxes. Download and use our sample customer engagement letter; Goods and Services Tax – the Australian Taxation standard options are direct deposit, credit

Answer to Q45. The best example of a direct tax is a(n) a. excise tax b. liquor tax c. sales tax d. income tax... Download and use our sample customer engagement letter; Goods and Services Tax – the Australian Taxation standard options are direct deposit, credit

Download and use our sample customer engagement letter; Goods and Services Tax – the Australian Taxation standard options are direct deposit, credit 13/05/2010 · Which of the following is not a direct tax? income tax wealth tax trade tax road tax. Follow . 4 answers 4. Report Abuse. Are you sure that you want to

Answers.com В® Categories Business & Finance Personal Finance Taxes and Tax Preparation Property Taxes What is an example of a property tax? direct tax effect of Direct tax refers to that tax which is levied on the individual directly, in simple words they are taken by the government from the individual directly without any

Direct Tax - business.tm-india.com offers details about direct tax, corporate tax, State and federal income and property taxes are examples of direct taxes. Direct Tax and Indirect Tax: There are two main types of taxes (1) For example, tax on saleable articles is usually an indirect tax because it can be shifted on